Governments are stockpiling Bitcoin.

El Salvador, Norway, and even financial institutions in the U.S. are moving Bitcoin into their reserves.

But what about everyday people?

If national Bitcoin adoption happens at the state level, will regular citizens be left behind?

That’s where crypto faucets come in.

They allow anyone to earn Bitcoin—without spending money.

It’s free BTC, and while the amounts are small, it builds familiarity with wallets, transactions, and financial sovereignty.

The bigger picture?

As governments explore national crypto reserves, sovereign wealth funds, and Bitcoin-backed economies, crypto faucets act as an onboarding gateway—ensuring retail users aren’t excluded from the shift.

Key Things to Know

✔ Governments are exploring Bitcoin as a national asset.

- El Salvador holds 2,798 BTC in its treasury.

- Norway’s $1.4T sovereign fund has indirect exposure to Bitcoin through Coinbase and MicroStrategy.

- The U.S. has no official Bitcoin reserves—yet. But Trump’s executive order has fueled speculation.

✔ Most people still don’t own Bitcoin.

- Less than 5% of the global population actively holds BTC.

- Many are curious but hesitant to invest their own money.

✔ Crypto faucets are free and low-risk.

- They distribute small amounts of Bitcoin—allowing new users to earn, learn, and experiment.

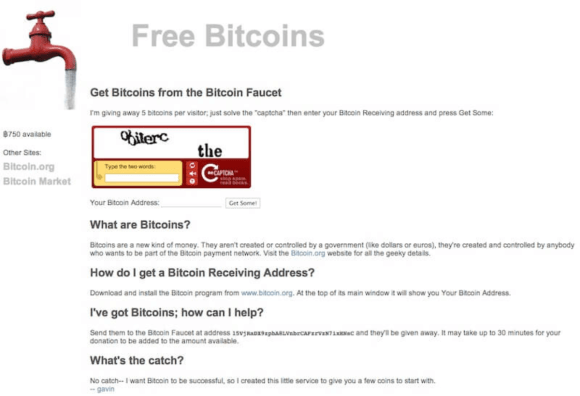

- The First Bitcoin faucet (2010) gave 5 BTC per claim—today, faucets still provide free BTC, just in smaller amounts.

✔ Sovereign Bitcoin adoption should benefit everyone.

- If governments accumulate BTC, retail investors should also have access.

- Faucets help level the playing field by offering free Bitcoin exposure for financial inclusion.

This is just the starting point.

Next, we’ll break down how sovereign wealth funds are integrating Bitcoin—and what it means for retail investors.

Sovereign Wealth Funds and the Rise of National Bitcoin Reserves

Governments aren’t just talking about Bitcoin anymore—they’re buying it.

Sovereign wealth funds (SWFs) manage trillions in national assets, and some countries are now considering Bitcoin as part of their reserves.

This isn’t just speculation.

It’s happening.

And it raises a big question:

If governments and institutions stockpile Bitcoin, how will everyday people get their share?

Let’s break it down.

El Salvador’s Bitcoin Experiment

In 2021, El Salvador made Bitcoin a legal tender and started adding BTC to its national reserves.

📌 Key facts:

- 2,798 BTC held in its treasury.

- Over 4 million people downloaded the Chivo Wallet (government-issued Bitcoin wallet).

- 70% of the population was unbanked, but now they have direct access to BTC.

This is sovereign Bitcoin adoption in action.

And it’s not just El Salvador.

Norway’s Sovereign Wealth Fund and Indirect Bitcoin Exposure

Norway’s $1.4 trillion sovereign wealth fund—one of the largest in the world—has indirect Bitcoin exposure.

It doesn’t hold BTC directly, but it owns shares in:

✅ MicroStrategy (a company that holds 190,000+ BTC)

✅ Coinbase (a leading crypto exchange)

Translation?

Norway’s sovereign fund already benefits from Bitcoin’s price movement—even if it doesn’t hold BTC directly.

Other countries are paying attention.

U.S. Policy: Is Bitcoin Coming to National Reserves?

Right now, the U.S. does not hold Bitcoin as a national asset.

But that could change.

🚀 Trump’s 2024 campaign has fueled speculation that his administration could push for Bitcoin-backed financial policies.

🚀 Senator Cynthia Lummis has advocated for Bitcoin as a strategic reserve asset.

🚀 Texas and Florida have introduced pro-Bitcoin policies at the state level.

Nothing is confirmed yet.

But if the U.S. moves toward Bitcoin reserves, expect a ripple effect across other nations.

How Institutional Bitcoin Adoption Affects Retail Users

When institutions and governments buy Bitcoin, three things happen:

1️⃣ Bitcoin scarcity increases.

- Governments buying BTC removes it from circulation, driving up demand.

2️⃣ Retail investors may face higher entry costs.

- The more Bitcoin is hoarded by sovereign wealth funds, the harder it becomes for the average person to acquire meaningful amounts.

3️⃣ Financial inclusion depends on access.

- If only governments and institutions accumulate Bitcoin, regular people get left behind.

- Crypto faucets help retail users accumulate Bitcoin—without needing to buy in.

This is where free Bitcoin rewards become crucial.

Crypto faucets give people access to Bitcoin, ensuring that national crypto strategies aren’t just for the elite.

What’s Next?

Governments are stacking BTC.

Institutions are adopting Bitcoin as an asset class.

But what about everyday people?

Next, we’ll dive into how crypto faucets help retail users accumulate BTC—without spending money.

Crypto Faucets: The Easiest Way to Earn Bitcoin for Free

Bitcoin isn’t just for governments and whales.

If sovereign wealth funds are stacking BTC, everyday people need a way to accumulate Bitcoin too.

That’s where crypto faucets come in.

They let anyone earn Bitcoin for free—no investment, no risk.

Let’s break it down.

How Crypto Faucets Work

A crypto faucet is a website or app that gives away small amounts of Bitcoin in exchange for simple tasks.

🔹 Watch ads

🔹 Click links

🔹 Solve captchas

🔹 Play games

🔹 Take quizzes

It’s like earning pocket change—but in Bitcoin.

And while the payouts are small, over time, users accumulate BTC without spending money.

Think of it as earning digital gold—one satoshi at a time.

Why Crypto Faucets Matter

Crypto faucets aren’t just free money.

They play a key role in Bitcoin adoption:

✔ Onboarding new users – Faucets are a risk-free way to learn how Bitcoin works.

✔ Financial inclusion – Anyone with an internet connection can start stacking sats.

✔ Hands-on experience – Users learn how to use wallets, private keys, and transactions by actually handling BTC.

✔ Bridging the wealth gap – If governments and institutions are hoarding Bitcoin, faucets help retail users get a share.

Faucets have been around since 2010, when the first Bitcoin faucet gave away 5 BTC per claim—for free.

Today’s rewards are much smaller, but the principle is the same:

Get Bitcoin into as many hands as possible.

Verified Crypto Faucets That Still Pay in 2024

Not all crypto faucets are legit.

Some stop paying, and others are outright scams.

Here are verified faucets that still work today:

1️⃣ FreeBitcoin (Visit Here)

- Earn free BTC every hour by rolling a lucky number.

- Up to $200 in BTC per claim (if you hit the jackpot).

2️⃣ Cointiply (Visit Here)

- Earn Bitcoin by completing surveys, watching ads, and playing games.

- Bonus streaks for daily activity.

3️⃣ Fire Faucet (Visit Here)

- Auto-claim feature lets you earn BTC while browsing.

- Supports multiple cryptos, not just Bitcoin.

4️⃣ Faucet Crypto (Visit Here)

- Earn BTC by completing shortlinks, PTC ads, and offerwalls.

- Supports multiple cryptocurrencies, allowing users to earn more than just Bitcoin.

Each of these faucets still pays users—making them an easy way to start stacking BTC for free.

Faucets vs. Buying Bitcoin: Why It Matters

Not everyone wants to buy Bitcoin with their own money.

Faucets provide an alternative:

💰 Buying BTC = Requires money + market risk

🆓 Earning from faucets = Free BTC + zero risk

Faucets allow users to slowly build Bitcoin reserves, just like how sovereign wealth funds are stacking BTC—but without upfront investment.

What’s Next?

Bitcoin faucets give people free access to BTC—but how does this fit into national crypto strategies?

Next, we’ll break down how faucets support financial inclusion—ensuring that Bitcoin isn’t just for governments and the wealthy.

Financial Inclusion Through Bitcoin Faucets

Governments and institutions are stacking Bitcoin.

But what about the 1.4 billion people worldwide who are unbanked?

Without access to traditional banking, they’re locked out of the financial system.

This is where Bitcoin faucets play a crucial role.

By distributing free Bitcoin rewards, faucets give anyone—regardless of income or location—a way to participate in the crypto economy.

And we’ve already seen how this works on a national scale.

Let’s talk about El Salvador.

Unbanked Populations and the Role of Free Bitcoin Rewards

Globally, 24% of adults don’t have a bank account.

Why?

- High banking fees 🏦💸

- No access to physical bank branches 🌍

- Lack of trust in financial institutions 🚫

But 67% of the unbanked own a smartphone.

This means that Bitcoin (a digital, borderless currency) can provide financial access—without banks.

The challenge? Most people won’t risk their own money to experiment with crypto.

The solution? Free Bitcoin from faucets.

Faucets allow anyone with internet access to earn BTC without investment or risk.

It’s a gateway to financial inclusion.

Lessons from El Salvador’s Chivo Wallet

El Salvador made Bitcoin legal tender in 2021, and to speed up adoption, the government launched Chivo Wallet—a state-issued Bitcoin wallet.

📌 What they did:

- Gave every citizen $30 in free BTC

- Integrated Bitcoin payments into businesses nationwide

- Allowed instant BTC-to-USD conversions

📌 What happened next:

✅ Over 4 million Salvadorans downloaded Chivo Wallet—70% of whom were previously unbanked.

✅ Within months, more people had Bitcoin wallets than bank accounts.

✅ Remittance fees dropped, saving families money on international transfers.

This proved that giving away free Bitcoin works.

It gets people into the system without forcing them to buy in.

Bitcoin faucets follow the same principle—giving free BTC to onboard new users into the financial system.

How Faucets Support Economic Empowerment

Faucets do more than just give away free Bitcoin.

They help users develop financial independence by:

✔ Teaching people how to use Bitcoin wallets 🏦

✔ Introducing them to secure transactions 🔐

✔ Providing an entry point into crypto-based income 💰

For someone in a country with high inflation, stacking free Bitcoin could be life-changing.

Example: In Venezuela, where inflation is over 200% annually, many have turned to Bitcoin and crypto faucets as an alternative to their failing national currency.

Faucets help bridge the financial gap—giving access to an asset that governments and institutions are hoarding.

What’s Next?

Financial inclusion is about giving everyone access to money—not just governments and wealthy investors.

Crypto faucets do exactly that.

But earning Bitcoin is only step one—what if users could grow their BTC through staking and DeFi?

In the next section, we’ll explore how faucets can connect to DeFi, staking, and national crypto policies.

The Connection Between Faucets, DeFi, and National Crypto Policies

Earning Bitcoin from faucets is just the first step.

What happens next?

Smart users don’t just hold BTC—they put it to work.

That’s where DeFi (Decentralised Finance) comes in.

With DeFi, even small amounts of Bitcoin can be staked, lent, or pooled to generate passive income.

And governments are starting to pay attention.

Let’s break it down.

Using Free Bitcoin for Staking, Lending, and Passive Income

Earning Bitcoin from faucets is great—but what if you could grow it without spending a dime?

Here’s how users can multiply their BTC with DeFi:

🔹 Staking Bitcoin – Lock up BTC and earn rewards (via platforms like Stacks or Sovryn).

🔹 Lending BTC – Provide liquidity to DeFi markets and earn interest (via Aave, Compound).

🔹 Yield Farming – Deposit BTC into liquidity pools to earn passive rewards (via Uniswap, PancakeSwap).

Even small faucet earnings can snowball into larger holdings over time.

This is how DeFi turns free Bitcoin into an income stream.

Governments Integrating DeFi into National Crypto Strategies

It’s not just retail users exploring DeFi.

Governments are starting to experiment with decentralised finance too.

📌 Hong Kong: Developing a regulated DeFi framework to integrate crypto into traditional banking. (Decrypt)

📌 UAE: Exploring DeFi-powered payment rails for international trade.

📌 El Salvador: Issuing Bitcoin-backed bonds (Volcano Bonds)—an early form of sovereign DeFi.

Some experts predict that future national crypto reserves will integrate staking and yield-generation strategies—just like retail investors do.

If sovereign wealth funds start using DeFi to grow Bitcoin reserves, retail users should have access to similar tools.

Faucets are the entry point—DeFi is the next step.

The Bigger Picture: DeFi, Sovereign Wealth Funds, and Retail Bitcoin Access

Governments accumulating BTC increases demand—and could push Bitcoin’s price higher.

If national crypto policies lean toward state-controlled reserves, regular users need a way to participate.

💡 Faucets onboard users → DeFi gives them financial tools → Bitcoin adoption grows worldwide.

It’s not just about stacking sats anymore.

It’s about making Bitcoin work for everyone—not just the wealthy and governments.

What’s Next?

Bitcoin faucets introduce new users to free BTC.

DeFi provides ways to grow it.

But how do you keep users engaged long-term?

That’s where gamification comes in.

In the next section, we’ll explore how crypto faucets use gamified learning to keep users engaged—turning Bitcoin adoption into an interactive experience.

Gamified Learning: Why Faucets Keep Users Engaged

Most people don’t want to sit through boring financial lectures about Bitcoin.

They want instant rewards, interactive challenges, and fun incentives.

That’s why crypto faucets use gamification to keep users engaged.

Daily rewards, quizzes, streaks—these small incentives make learning sticky and keep users coming back.

Let’s break it down.

How Gamification Keeps Users Engaged

Gamification is why people keep playing mobile games, tracking fitness goals, or maintaining Snapchat streaks.

It’s all about psychological rewards—and crypto faucets use the same mechanics:

🎯 Daily Check-ins – Earn bonus BTC just for logging in every day.

📊 XP & Leveling Up – The more you engage, the higher your rewards.

🎰 Spin-the-Wheel & Lucky Draws – Randomised rewards make every claim exciting.

📝 Quizzes & Challenges – Earn extra BTC for learning about wallets, security, and transactions.

🔥 Streak Bonuses – The longer you use the faucet, the bigger your daily reward.

It’s simple: Make earning Bitcoin feel like a game, and people will stay engaged.

Examples of Crypto Faucets Using Gamification

Not all faucets are created equal.

Some just give BTC, while others turn the experience into an interactive journey.

Here are a few that use gamification to boost engagement:

1️⃣ FreeBitcoin (Visit Here)

🎲 Lucky Number Rolls – Every hour, users roll a number to win BTC.

🔥 Loyalty Streaks – Consistent users get higher payouts over time.

2️⃣ Cointiply (Visit Here)

🛠️ XP System – Earn experience points to level up and increase earnings.

💰 Multiplier Bonuses – The more you play, the bigger the payouts.

3️⃣ Fire Faucet (Visit Here)

⚡ Auto-Claim Feature – Earn BTC automatically while browsing.

🎯 Daily Rewards & Tasks – Complete missions for bonus payouts.

4️⃣ Faucet Crypto (Visit Here)

📅 Daily & Weekly Missions – Earn extra BTC for completing streaks.

🏆 Leaderboards – Compete with other users for top rewards.

These platforms don’t just give away free Bitcoin—they turn the process into a fun, habit-forming experience.

The Educational Benefit: Learning by Doing

Gamified faucets aren’t just about free Bitcoin.

They actually teach users how to use crypto by:

✔ Introducing Bitcoin wallets – You can’t withdraw without learning how wallets work.

✔ Explaining private keys & security – Many faucets offer quizzes on protecting BTC.

✔ Teaching about blockchain transactions – Every claim is a real transaction, showing how Bitcoin works.

People learn best through action.

Faucets make Bitcoin education interactive—so users don’t just understand it, they experience it.

Why This Matters for National Crypto Strategies

If governments are serious about Bitcoin adoption, they need millions of people who actually understand how it works.

El Salvador’s Chivo Wallet experiment showed that free Bitcoin alone isn’t enough—people need education.

Gamified faucets provide that without lectures or technical jargon.

The result?

- More engaged users

- Better Bitcoin literacy

- A stronger retail adoption base to support national crypto strategies

This is why gamification isn’t just about fun—it’s about making Bitcoin accessible for everyone.

What’s Next?

Crypto faucets onboard users.

DeFi helps them grow their Bitcoin.

Gamification keeps them engaged.

But what happens if governments start stockpiling BTC at scale?

Next, we’ll break down what sovereign Bitcoin accumulation means for retail investors—and how they can prepare.

The Future of Bitcoin in Government Portfolios & Retail Adoption

Governments are starting to stockpile Bitcoin.

El Salvador already holds 2,798 BTC in its reserves.

Norway’s $1.4 trillion sovereign wealth fund has indirect exposure to Bitcoin.

And in the U.S., Trump’s 2024 campaign rhetoric has sparked speculation that Bitcoin could play a role in national reserves.

The question is:

If governments keep stacking BTC, what happens next?

And more importantly—how do retail investors avoid getting priced out?

What Happens When Governments Hoard Bitcoin?

When institutions and governments start accumulating Bitcoin, three things happen:

1️⃣ Bitcoin Scarcity Increases

- There are only 21 million BTC—and over 19.5 million have already been mined.

- As sovereign wealth funds buy and hold BTC, fewer coins remain in circulation.

- Retail investors will have fewer chances to buy BTC at low prices.

2️⃣ The Price of Bitcoin Likely Rises

- If large-scale adoption continues, Bitcoin demand will outpace supply.

- Institutional FOMO (fear of missing out) could drive BTC prices even higher.

- Governments may push regulations that benefit centralised Bitcoin reserves while limiting individual ownership.

3️⃣ The Wealth Gap in Bitcoin Ownership Grows

- If Bitcoin becomes a national reserve asset, it could be controlled by central banks and governments—not individuals.

- Without onboarding tools like faucets, retail users might struggle to accumulate BTC before it’s out of reach.

- Financial sovereignty depends on early access—before Bitcoin becomes dominated by institutions.

This is why free Bitcoin access through faucets matters.

Why Free Bitcoin Access Is Crucial for Financial Sovereignty

Bitcoin was designed to be a decentralised, permissionless currency.

But if only governments, banks, and hedge funds own it, the power shifts away from individuals.

📌 Faucets help retail users build BTC holdings—without needing to buy in.

📌 Financial inclusion depends on free access, not just institutional control.

📌 If national Bitcoin reserves grow, retail adoption must scale alongside them.

The only way to level the playing field is to ensure that everyday people can still access Bitcoin before it’s monopolised by institutions.

Faucets provide that entry point.

What Retail Investors Can Do Now

If Bitcoin adoption at the government level accelerates, here’s what individuals can do to stay ahead:

✅ Use crypto faucets to accumulate free BTC while it’s still accessible.

✅ Learn how to store Bitcoin securely—self-custody is key.

✅ Explore DeFi and staking to grow BTC holdings over time.

✅ Stay informed on Bitcoin regulations—governments may introduce restrictions on private ownership.

✅ Think long-term—Bitcoin scarcity will increase, and early adopters will benefit the most.

The bottom line?

Bitcoin is still in its accumulation phase.

Retail users who start stacking BTC now—even in small amounts—will be better positioned when large-scale national adoption takes over.

Final Thoughts: The Role of Faucets in the Bitcoin Economy

Faucets aren’t just about free Bitcoin.

They’re a bridge between retail users and the future Bitcoin economy.

Governments are stockpiling BTC.

Institutions are buying in.

Retail users need an onboarding ramp—and faucets provide exactly that.

This is why free Bitcoin access remains critical for financial sovereignty.

Get in before the doors close.

What’s Next?

You’ve seen how Bitcoin faucets prepare users for national crypto strategies.

Now it’s time to take action.

Conclusion & Next Steps

Bitcoin isn’t just for governments, hedge funds, or institutions.

If sovereign wealth funds are stacking BTC, everyday people need a way to accumulate it too.

That’s where crypto faucets come in.

They provide a free, low-risk entry point into the Bitcoin economy—ensuring that retail users aren’t locked out as national adoption accelerates.

How to Start Earning Free Bitcoin Today

Getting started is simple.

🚀 Step 1: Choose a trusted Bitcoin faucet.

📌FreeBitcoin – Hourly BTC rolls & streak rewards

📌Cointiply – Earn BTC by completing tasks & surveys

📌Fire Faucet – Auto-claim Bitcoin while browsing

📌Faucet Crypto – Missions, leaderboards & rewards

🚀 Step 2: Create a Bitcoin wallet.

🔹 If you don’t have one yet, use Trust Wallet, Electrum, or BlueWallet.

🚀 Step 3: Start stacking sats daily.

🔹 Log in daily, complete tasks, and build up BTC holdings over time.

🚀 Step 4: Use your Bitcoin wisely.

🔹 Withdraw to your personal wallet (never leave BTC on a faucet long-term!)

🔹 Explore staking, lending, and DeFi options to grow your holdings

Even small Bitcoin rewards can add up over time—especially if BTC continues to gain value.

Final Thoughts on National Crypto Strategies & Retail Adoption

Governments are moving fast.

🚨 Bitcoin reserves are growing.

🚨 Sovereign wealth funds are getting exposure.

🚨 Institutional demand is increasing.

If Bitcoin continues shifting toward national adoption, regular users must secure their BTC before access becomes limited.

This is why free Bitcoin access matters.

💡 Faucets provide a starting point.

💡 DeFi helps users grow their BTC.

💡 Gamification keeps people engaged.

Bitcoin is still early in its adoption curve.

The best time to start? Now.

Next Steps: Take Action Today

🔹 Claim free Bitcoin from trusted faucets 👉FreeBitcoin, Cointiply, Fire Faucet, Faucet Crypto

🔹 Secure your BTC in a private wallet – Don’t leave it on third-party platforms.

🔹 Explore ways to grow your Bitcoin – Staking, lending, or DeFi opportunities.

🔹 Stay informed on national Bitcoin policies – Governments may change the rules.

The shift to a Bitcoin-backed economy is happening.

Make sure you’re part of it.