The financial system is shifting.

Traditional fiat is losing ground, while stablecoins are becoming the go-to alternative for payments, savings, and decentralised finance (DeFi).

Big players are getting involved. JPMorgan, Visa, and BlackRock are integrating stablecoins into their financial models. Governments are scrambling to regulate them, with Central Bank Digital Currencies (CBDCs) emerging as a direct response.

But here’s the real game-changer:

Crypto faucets, once used for free Bitcoin, are now onboarding users into stablecoins and DeFi.

Instead of just giving away tiny amounts of Bitcoin, today’s faucets offer free stablecoins, teaching users how to store, spend, and earn yield in the new digital economy.

This article breaks down how faucets are playing a critical role in preparing individuals for a stablecoin-powered financial system.

Key Things to Know

- Stablecoins are replacing fiat in global finance. USDC, DAI, and USDT process trillions of dollars annually, rivalling traditional payment networks.

- Governments are paying attention. The U.S. and EU are pushing stablecoin regulations, while China is testing a digital yuan (CBDC) to compete.

- Crypto faucets are evolving. Once simple Bitcoin drip platforms, they now distribute stablecoins, educating users on wallets, transactions, and DeFi tools.

- DeFi is the new banking system. Stablecoins allow users to stake, lend, and earn passive income without relying on banks.

- Faucets provide a risk-free entry point. Users can earn and experiment with stablecoins before investing their own money.

The shift is happening fast, and crypto faucets are making sure that everyone gets a fair shot at the new financial system.

The Rise of Stablecoins as a Fiat Alternative

The global financial system is shifting toward digital assets, and stablecoins are leading the transition.

Originally designed to provide price stability in the volatile crypto market, stablecoins are now competing with traditional payment networks and banking systems. They enable instant, borderless transactions, eliminate the inefficiencies of fiat banking, and offer individuals and institutions a more reliable way to store and transfer value.

Governments, corporations, and even political figures are taking notice. Regulatory discussions, institutional adoption, and political speculation around stablecoins suggest they could replace fiat in key financial sectors.

Here’s why stablecoins are emerging as a serious alternative to traditional money.

Stablecoins Are Becoming a Global Payment Solution

Stablecoins are filling the gaps left by traditional banking systems. While bank transfers are slow and costly, stablecoins offer near-instant transactions with low fees.

- Cross-border payments: International transactions can take days to clear with SWIFT. Stablecoins settle in minutes, making them ideal for global commerce.

- Merchant adoption: Companies like Visa and PayPal are integrating stablecoins into payment systems, making them more accessible for everyday use.

- Decentralised finance (DeFi): Stablecoins power DeFi platforms, allowing users to lend, borrow, and earn interest without banks.

The utility of stablecoins is pushing them further into the mainstream, with growing demand from businesses and financial institutions.

Key Statistics: Market Growth and Adoption

The stablecoin market has exploded over the past few years. Here are the latest numbers that show how rapidly they’re gaining traction:

- Market capitalisation: Stablecoins now exceed $130 billion, up from $30 billion in 2021.

- Transaction volume: In 2023, Tether (USDT) alone processed over $18 trillion, surpassing Visa’s annual transaction volume of $14 trillion.

- Institutional adoption: Major financial players like BlackRock, JPMorgan, and Fidelity have begun integrating stablecoins into investment and payment systems.

- USDC usage: USDC has processed over $12 trillion in on-chain transactions, with growing adoption among fintech companies.

These numbers make it clear: stablecoins are no longer a niche product. They are actively competing with the traditional banking system.

How Stablecoins Compare to Eurodollars in Global Trade

For decades, Eurodollars (U.S. dollars held in offshore bank accounts) have been the backbone of global trade. Countries and corporations rely on them to conduct international business, bypassing local currency restrictions.

But stablecoins could replace Eurodollars by offering a faster, more transparent, and more accessible alternative.

Here’s how stablecoins stack up against Eurodollars:

| Feature | Eurodollars | Stablecoins |

| Accessibility | Requires a bank | Accessible with a crypto wallet |

| Settlement Time | 2-3 days (SWIFT) | Instant or within minutes |

| Transparency | Limited visibility | Fully auditable on-chain |

| Transaction Costs | High fees | Low fees |

| Counterparty Risk | Bank default risk | Smart contract risk |

Stablecoins could disrupt the existing offshore dollar system, reducing reliance on traditional banks and reshaping how global trade is conducted.

Trump’s Crypto-Friendly Stance and the $10 Trillion Speculation

Former President Donald Trump has expressed support for crypto, especially Bitcoin mining and financial innovation in the sector. His administration previously explored stablecoin regulations, and some believe a future Trump presidency could push for stablecoins as a replacement for Eurodollars.

The speculation around a $10 trillion crypto bet stems from the idea that the U.S. could shift toward a digital dollar standard, backing stablecoins with U.S. reserves or integrating them into the global financial system.

While no formal policy has been announced, here’s what Trump has publicly supported:

- Pro-crypto stance: He has stated that the U.S. should be a leader in blockchain innovation and has criticised excessive regulations on crypto.

- Bitcoin mining support: Trump has shown favour toward U.S.-based Bitcoin mining operations, which could signal broader support for digital asset infrastructure.

- CBDCs vs. stablecoins: Some reports suggest Trump would oppose government-controlled CBDCs in favour of privately issued stablecoins.

Although a $10 trillion crypto strategy is purely speculative, the possibility of stablecoins playing a central role in U.S. financial policy is becoming more realistic.

Stablecoins Are Reshaping Global Finance

With their rapid adoption, institutional backing, and growing role in global trade, stablecoins are positioning themselves as a true alternative to fiat.

Crypto faucets are now introducing millions of users to stablecoins, providing a risk-free way to earn and experiment with digital money. This is paving the way for wider adoption, ensuring that both individuals and institutions are prepared for a financial system where stablecoins dominate.

Next, we’ll look at how crypto faucets are driving stablecoin adoption and onboarding users into the new digital economy.

How Crypto Faucets Onboard Users Into a Stablecoin Economy

Stablecoins are transforming global finance, but there’s one major barrier to mass adoption—onboarding new users into the system.

Most people are still unfamiliar with stablecoins, DeFi, and how digital wallets work. Buying crypto can feel complicated, and financial risk discourages many from experimenting with new technologies.

This is where crypto faucets come in.

Originally designed to distribute small amounts of Bitcoin for free, faucets have evolved into powerful educational tools that provide risk-free access to stablecoins. They allow users to earn digital assets without financial commitment, making it easier to understand and adopt the new financial system.

Here’s how crypto faucets are accelerating stablecoin adoption and bringing more people into decentralised finance.

What Are Crypto Faucets? From Bitcoin Giveaways to Stablecoin Rewards

Crypto faucets are platforms that distribute small amounts of cryptocurrency for free in exchange for simple tasks, such as:

- Completing a CAPTCHA or quiz

- Watching a short video or ad

- Clicking a claim button every few hours

- Testing blockchain-based applications

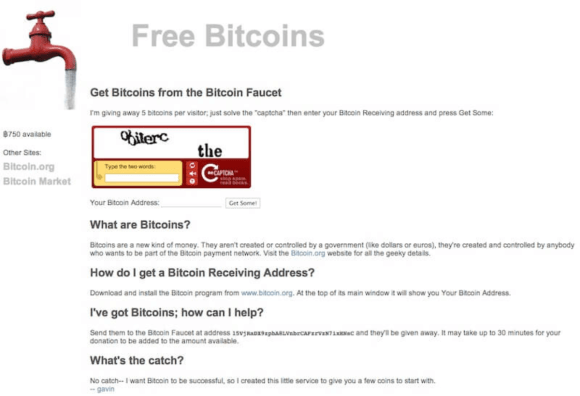

How it started: In 2010, Bitcoin developer Gavin Andresen created the first-ever crypto faucet, giving away 5 BTC per user—now worth millions of dollars—to introduce people to Bitcoin.

How it’s going: Today, faucets have expanded beyond Bitcoin, rewarding users with stablecoins like USDC, DAI, and USDT. This shift has made faucets even more relevant, as stablecoins provide a direct gateway into digital payments, DeFi, and global finance.

Unlike early faucets that simply handed out Bitcoin, modern faucets teach users how to interact with crypto wallets, send transactions, and explore DeFi applications.

Free Stablecoin Access: Making Crypto Adoption Risk-Free

One of the biggest challenges with crypto adoption is the barrier to entry. Buying stablecoins requires a bank account, an exchange account, and sometimes complex KYC verification.

Faucets eliminate this problem by offering free stablecoins with no financial risk.

Here’s why this matters:

- Users don’t need to invest upfront—they can earn stablecoins for free and learn how transactions work before making financial commitments.

- No credit card or bank account required, making stablecoins accessible in regions with limited banking infrastructure.

- Instant exposure to DeFi—users can start experimenting with staking, lending, and liquidity pools without risking their own funds.

By removing financial risk, faucets give millions of people a safe, hands-on introduction to stablecoins and decentralised finance.

Financial Inclusion: How Faucets Provide Access to Digital Assets

Millions of people worldwide lack access to traditional banking, but crypto offers an alternative.

Stablecoins are particularly useful in emerging markets, where inflation and banking restrictions make it difficult to save and transfer money. Crypto faucets help bridge this gap by offering free digital dollars to anyone with an internet connection.

Why Faucets Matter for Financial Inclusion:

- Unbanked users can access stablecoins for free. No need for a bank account or credit history.

- Faucets offer a safe way to store value. Unlike volatile local currencies, stablecoins like USDC and DAI maintain a stable price.

- Global remittances become cheaper. Users can send stablecoins across borders with minimal fees, avoiding expensive remittance services.

In countries with high inflation or unstable banking systems, stablecoins provide a reliable way to save money and make transactions. Faucets make sure that people in these regions can access digital assets without financial hurdles.

Learning Through Faucets: Wallets, Transactions, and DeFi Basics

Faucets do more than distribute free stablecoins—they also teach users how to use them.

A first-time crypto user can claim stablecoins from a faucet and immediately learn:

- How to set up a crypto wallet (Metamask, Trust Wallet, or Coinbase Wallet).

- How to send and receive stablecoins using blockchain addresses.

- How stablecoin transactions work on different networks (Ethereum, Polygon, Solana).

- Basic DeFi concepts like staking, swapping, and liquidity pools.

Some modern faucets even gamify learning, offering extra rewards for completing blockchain-based quizzes or testing new DeFi applications.

By engaging users in a hands-on way, faucets shorten the learning curve and drive real adoption.

Faucets Are the Gateway to a Stablecoin Economy

Stablecoins are replacing traditional finance, but onboarding millions of users takes education, accessibility, and zero-risk experimentation.

Crypto faucets solve all three problems by:

- Providing free stablecoins, eliminating financial risk for new users.

- Promoting financial inclusion, giving people in emerging markets access to digital assets.

- Teaching DeFi fundamentals, helping users navigate decentralised finance with confidence.

As stablecoins continue to expand, crypto faucets will remain one of the most powerful tools for mass adoption.

Next, we’ll explore how DeFi and stablecoins are reshaping the future of banking—eliminating the need for traditional financial institutions.

DeFi and the Role of Stablecoins in the Future of Banking

Traditional banking is slow, expensive, and full of unnecessary restrictions. Stablecoins and decentralised finance (DeFi) are replacing that system with borderless, permissionless, and interest-generating financial tools—without the need for banks.

Stablecoins are now the foundation of DeFi, allowing users to store value, earn passive income, and access loans without intermediaries.

Crypto faucets are playing a key role in this transition by introducing new users to stablecoins and DeFi tools without financial risk.

Here’s how stablecoins are reshaping banking and why DeFi is the future of finance.

Stablecoins: The Foundation of Decentralised Banking

DeFi platforms operate without banks, relying on stablecoins as their primary unit of account. Unlike volatile cryptocurrencies like Bitcoin or Ethereum, stablecoins maintain a steady value, making them ideal for financial transactions.

With stablecoins, users can:

- Store money digitally without relying on banks.

- Make instant payments with low transaction fees.

- Participate in DeFi protocols for lending, borrowing, and earning yield.

Because stablecoins work on blockchain networks, transactions are transparent, auditable, and available to anyone with internet access. This eliminates the need for centralised banking authorities.

Crypto faucets help users take their first step into this new financial system by offering free stablecoins and teaching them how to use DeFi tools safely.

Earning Passive Income by Staking Stablecoins

In traditional finance, savings accounts offer minimal interest—sometimes as low as 0.01% annually.

DeFi changes this by allowing users to stake stablecoins and earn passive income at rates significantly higher than banks.

Here’s how stablecoin staking works:

- Users deposit stablecoins into DeFi protocols like Aave, Compound, or Curve.

- The funds are lent out to borrowers, generating interest.

- Users earn a share of that interest, often ranging from 2% to 10% APY, depending on market demand.

Instead of letting banks profit from deposits, DeFi puts the earnings directly into users’ wallets.

Crypto faucets lists introduce users to staking by giving them free stablecoins to experiment with. This allows them to test out DeFi platforms and earn yield without financial risk.

Smart Contract Lending: Borrowing Stablecoins Without Banks

In traditional banking, getting a loan requires:

- A high credit score

- Approval from a bank

- Weeks of waiting

DeFi eliminates these barriers with smart contract lending, where users can borrow stablecoins instantly without credit checks or paperwork.

Here’s how it works:

- Users deposit collateral (e.g., Ethereum or Bitcoin) into a DeFi lending platform.

- A smart contract automatically approves the loan, issuing stablecoins based on the collateral value.

- Users repay the loan with interest—if they fail to do so, their collateral is liquidated.

This system ensures fast, permissionless lending while maintaining financial security.

By using free stablecoins from faucets, new users can test out lending platforms without risking their own funds, making it easier to understand how DeFi loans work.

The Impact on Cross-Border Payments: Eliminating Remittance Fees and Delays

Sending money internationally is slow and expensive.

- Bank transfers can take days to process.

- Traditional remittance services charge fees as high as 10%.

Stablecoins solve this problem by enabling instant, low-cost transactions across borders.

For example:

- A user in the U.S. can send USDC to a family member in India within minutes, bypassing banks and saving on fees.

- A freelancer in Africa can receive payments in DAI without worrying about currency devaluation.

- Merchants can accept stablecoin payments globally without relying on credit card processors.

This creates a fairer financial system, especially for people in developing countries who lose billions in remittance fees each year.

Faucets help people get started by providing free stablecoins, allowing them to test cross-border transactions before using them for real-world payments.

How Faucets Introduce Users to DeFi Banking Tools

Crypto faucets are more than just free money—they serve as hands-on learning platforms for the future of finance.

With faucets, users can:

- Earn stablecoins risk-free, gaining their first exposure to DeFi.

- Learn how to stake stablecoins, earning passive income without needing a bank.

- Experiment with DeFi lending, understanding how smart contract-based loans work.

- Test cross-border payments, seeing firsthand how fast and cheap stablecoin transfers are.

This approach removes financial barriers and makes DeFi accessible to anyone, regardless of their background or technical knowledge.

DeFi and Stablecoins Are Replacing Traditional Banking

Stablecoins are no longer just crypto assets—they are becoming the backbone of decentralised finance, offering a faster, cheaper, and more transparent alternative to traditional banking.

DeFi platforms allow users to:

- Store and transfer money without banks.

- Earn high interest by staking stablecoins.

- Borrow and lend without credit checks.

- Send payments across borders instantly.

Crypto faucets are playing a key role in this transition by giving users risk-free access to stablecoins and helping them learn how to use DeFi tools.

Next, we’ll explore how gamified learning is making stablecoin education more engaging—helping users adopt DeFi faster and with greater confidence.

Gamified Learning: How Faucets Are Teaching DeFi Concepts

Crypto is complex.

Most people don’t have the time or patience to read whitepapers or watch hour-long tutorials on stablecoins and decentralised finance (DeFi). They need a hands-on, engaging way to learn—and that’s exactly where gamified learning comes in.

Crypto faucets are no longer just about free token giveaways. Today, they’re interactive learning platforms that teach users how to use stablecoins, make transactions, and participate in DeFi—all while earning small rewards.

By turning crypto education into an engaging experience, faucets are helping more people adopt stablecoins and DeFi faster than ever.

Why Interactive Learning Models Are Driving Adoption

Traditional learning methods don’t work well for crypto.

- Reading about DeFi isn’t the same as using it. Concepts like staking, liquidity pools, and smart contracts are best understood through real-world application.

- Most new users are afraid of losing money. Faucets remove the financial risk by letting users experiment with stablecoins for free.

- Crypto has a high barrier to entry. Gamified learning makes it easy for anyone—regardless of their technical knowledge—to start using stablecoins and DeFi tools immediately.

Interactive models keep users engaged, making it more likely they’ll retain what they’ve learned and continue exploring the DeFi ecosystem.

Examples of Gamified Faucets: Earning Stablecoins by Completing Blockchain Tasks

Some modern faucets reward users with stablecoins for completing small tasks that teach them how crypto works. These tasks can include:

- Solving blockchain quizzes – Answer questions about stablecoins, smart contracts, or DeFi concepts to earn rewards.

- Testing DeFi tools – Faucets provide free stablecoins that users can stake, lend, or swap to learn how DeFi platforms work.

- Completing wallet setup challenges – Users earn rewards by setting up a crypto wallet, securing their private keys, and making their first transaction.

- Participating in NFT or token airdrops – Some faucets offer NFTs or governance tokens for interacting with new blockchain projects.

By rewarding learning, these faucets encourage users to actively engage with crypto instead of just reading about it.

Simulating Real-World Use Cases: Payments, Lending, and Staking

A key reason why people hesitate to use crypto is that they don’t understand how it applies to everyday life.

Gamified faucets bridge this gap by simulating real-world financial activities in a safe, low-risk environment.

How Faucets Teach Real-World Crypto Use Cases:

| Use Case | How Faucets Simulate It |

| Making Payments | Users send small amounts of stablecoins to practice real transactions. |

| Staking Rewards | Faucets let users stake free stablecoins to learn how passive income works. |

| Borrowing in DeFi | Users can simulate taking a stablecoin loan and see how repayment works. |

| Providing Liquidity | Some faucets introduce liquidity pools, showing users how to earn fees by supplying stablecoins. |

By actively using stablecoins in a controlled environment, users build confidence and are more likely to continue using them in real-world transactions.

How Gamification Boosts User Engagement and Retention

Gamified learning keeps users coming back, which is crucial for long-term adoption.

- Small rewards encourage repeat usage. Earning stablecoins for completing simple tasks keeps users engaged.

- Challenges and progress tracking create motivation. Platforms that offer badges, experience points, or leaderboards make learning competitive and fun.

- Social features increase participation. Faucets that integrate forums, referral bonuses, or multiplayer challenges drive higher retention rates.

This model is already working in other industries—apps like Duolingo and Khan Academy have used gamification to make learning engaging. Now, crypto faucets are applying the same principles to stablecoin education.

Gamification Is the Future of Crypto Adoption

Crypto is moving away from complex, technical learning models toward interactive, hands-on education.

Faucets are leading this shift by:

- Offering risk-free stablecoin rewards to encourage real engagement.

- Simulating real-world DeFi applications to help users understand stablecoins in action.

- Using gamification strategies to keep users engaged and improve retention.

By making crypto education more interactive, faucets are helping millions of users onboard into a stablecoin economy faster than ever before.

Next, we’ll look at how governments are responding to stablecoin adoption, the rise of CBDCs, and what it means for financial sovereignty.

Stablecoin Regulation and the Future of Financial Sovereignty

Governments are waking up to stablecoins.

What started as a tool for crypto traders has now grown into a serious alternative to traditional fiat currencies. With trillions of dollars in transaction volume, stablecoins like USDT, USDC, and DAI are challenging the financial system, forcing regulators to take action.

But regulation isn’t just about control—it’s about who gets to define the future of money.

Governments are pushing Central Bank Digital Currencies (CBDCs) as an alternative to privately issued stablecoins, while regulators debate how to handle decentralised assets. At the same time, crypto faucets are playing a key role in educating users on financial sovereignty, helping them understand the differences between controlled and decentralised digital money.

Here’s how stablecoin regulation is evolving—and why it matters for the future of financial independence.

How Governments Are Responding to Stablecoin Growth

Stablecoins have reached a point where regulators can no longer ignore them.

- The U.S. House Financial Services Committee has proposed stablecoin bills aimed at defining how private companies can issue and manage them.

- The European Union has integrated stablecoins into its MiCA (Markets in Crypto-Assets) regulatory framework, requiring issuers to meet stricter compliance standards.

- China has banned private stablecoins in favour of its state-controlled digital yuan (CBDC).

- The International Monetary Fund (IMF) is warning that unregulated stablecoins could challenge the power of central banks.

Governments don’t like losing control over money, and stablecoins threaten their ability to manage national currencies.

The key question is whether regulators will support stablecoin innovation or try to shut it down in favour of government-controlled alternatives.

CBDCs vs. Decentralised Stablecoins: Competing Financial Models

Central banks see the rise of stablecoins as a challenge to their power, which is why they are pushing Central Bank Digital Currencies (CBDCs) as an alternative.

But CBDCs and stablecoins are built on two completely different financial models.

| Feature | CBDCs | Decentralized Stablecoins |

| Who controls it? | Central banks | No single entity (DAI, FRAX) |

| Privacy | Full government oversight | Private transactions possible |

| Financial inclusion | Permissioned access | Open to anyone |

| Inflation control | Centralised monetary policy | Algorithmic or asset-backed |

| Use case | Government-issued digital money | Free-market alternative |

Governments argue that CBDCs provide stability, but critics point out that they give central banks even more control over financial transactions—including the ability to track spending and freeze accounts.

On the other hand, decentralised stablecoins like DAI and FRAX operate outside government control, giving users true financial sovereignty.

The battle between CBDCs and decentralised stablecoins is about who controls money in the digital age—and the outcome will shape the future of financial freedom.

New Stablecoin Regulations and Their Impact on Users

Governments aren’t banning stablecoins outright, but they are increasing regulation to bring them under state control.

Here’s how upcoming stablecoin regulations could affect users:

- Stricter compliance for issuers – Companies like Circle (USDC) and Tether (USDT) may face higher reserve requirements and government audits.

- KYC (Know Your Customer) rules – Users may be required to verify their identity before using certain stablecoins.

- Limits on decentralised stablecoins – Algorithmic and crypto-backed stablecoins (like DAI) could face more restrictions or outright bans in some countries.

- Taxation and reporting requirements – Stablecoin transactions may be subject to new tax laws, forcing users to report holdings and payments.

While regulation can increase trust in stablecoins, excessive restrictions could push users toward fully decentralised alternatives, creating an underground financial system.

Crypto faucets are already helping users prepare for this shift by educating them on regulatory changes and how to maintain financial sovereignty.

The Role of Faucets in Educating Users on Financial Sovereignty

Crypto faucets are more than just a tool for free stablecoins—they are also a way to learn about financial independence.

As governments push for more control over digital currencies, faucets can teach users:

- How to use decentralised stablecoins like DAI and FRAX that operate outside government oversight.

- Why CBDCs are different from stablecoins, helping users understand the risks of government-controlled money.

- How to store stablecoins securely, ensuring privacy and self-custody of digital assets.

- How to use DeFi platforms without relying on centralised exchanges or regulated financial services.

Faucets provide a risk-free way to experiment with stablecoins, giving users first-hand experience with decentralised finance before new regulations take effect.

Stablecoin Regulation Will Define the Future of Money

Governments are tightening control over stablecoins, but the demand for decentralised financial tools is only growing.

CBDCs and regulated stablecoins may become part of the system, but people will continue seeking alternative financial solutions that offer privacy, accessibility, and self-custody.

Crypto faucets are ensuring that users are prepared for this future—helping them understand how to navigate the changing landscape of stablecoins, regulations, and financial sovereignty.

Next, we’ll explore how crypto faucets will continue to evolve, integrating new stablecoin rewards and DeFi opportunities for users worldwide.

The Future of Digital Payments and the Role of Crypto Faucets

Stablecoins are doing what banks and payment networks couldn’t—offering instant, low-cost, and borderless transactions without restrictions.

They are already replacing traditional financial systems in key areas:

- Global remittances – Stablecoins settle transactions in minutes, cutting out high remittance fees.

- E-commerce and payments – Businesses accept USDC and USDT as alternatives to credit cards.

- DeFi banking – Users earn yield on stablecoin deposits without relying on banks.

As adoption grows, crypto faucets will evolve beyond simple giveaways, becoming onboarding platforms for the next generation of digital finance.

Here’s how faucets are shaping the future of digital payments and stablecoin adoption.

Stablecoins Are Replacing Traditional Finance

Stablecoins are no longer just a crypto alternative—they are becoming a mainstream payment solution.

- USDT and USDC settle trillions in transactions, competing with Visa and Mastercard.

- Merchants and e-commerce platforms are integrating stablecoins to avoid high credit card fees.

- Financial institutions like BlackRock and JPMorgan are experimenting with stablecoin-based payment rails.

Unlike traditional banking systems, stablecoins operate 24/7, with no bank approvals, no long processing times, and no unnecessary fees.

As stablecoins take over payments, crypto faucets will serve as the entry point for millions of new users.

The Evolution of Crypto Faucets

Faucets have come a long way from simply handing out free Bitcoin. Now, they are evolving into full-scale stablecoin adoption tools.

1. Supporting Multiple Stablecoins

Early faucets mostly rewarded users with Bitcoin, but today’s platforms are expanding to include:

- USDC and USDT – The most widely adopted stablecoins, backed by fiat reserves.

- DAI and FRAX – Decentralised, crypto-backed stablecoins.

- Algorithmic stablecoins – Emerging stablecoins designed to maintain stability without direct fiat backing.

By offering a variety of stablecoins, faucets allow users to experiment with different types of digital assets and find what works best for them.

2. Integrating DeFi Staking to Generate Passive Income

Traditional savings accounts offer little to no interest, while DeFi allows users to stake stablecoins and earn competitive yields.

Faucets are beginning to integrate staking rewards, where users can:

- Stake stablecoins directly from faucet rewards and earn yield.

- Participate in liquidity pools, helping to facilitate stablecoin trading.

- Learn how to generate passive income without relying on banks.

This feature turns free stablecoins from faucets into income-generating assets, helping users understand DeFi in a hands-on way.

3. Providing Free Access to Financial Education on Blockchain Payments

A major barrier to stablecoin adoption is a lack of knowledge. Most people don’t know how to:

- Set up a crypto wallet.

- Send and receive stablecoins.

- Use stablecoins for payments or savings.

Faucets are solving this by integrating educational modules, rewarding users for completing:

- Step-by-step wallet setup tutorials.

- Blockchain transaction simulations.

- DeFi and staking walkthroughs.

By offering real incentives for learning, faucets bridge the gap between knowledge and adoption.

Why Faucets Will Remain Essential for Mass Adoption

As stablecoins become a dominant force in digital payments, faucets will continue to play a critical role in onboarding new users.

Faucets ensure:

- Anyone can access stablecoins for free, reducing entry barriers.

- Users can safely learn about blockchain payments before investing.

- New DeFi users can experiment with staking and lending without financial risk.

Stablecoins are reshaping how people transact, save, and invest. Crypto faucets are ensuring that everyone—regardless of background or location—can be part of this financial revolution.

Stablecoins, DeFi, and Crypto Faucets Are the Future

The transition away from traditional finance has already begun.

- Stablecoins are replacing slow, expensive banking services.

- DeFi is offering financial tools without middlemen.

- Crypto faucets are bridging the gap, providing free access and education.

As more people adopt stablecoins for payments, savings, and investments, faucets will remain a key entry point, ensuring that mass adoption happens at every level.

Conclusion

The financial system is changing faster than ever.

Stablecoins and DeFi are replacing traditional finance, offering faster payments, better savings opportunities, and financial tools that work without banks. As adoption grows, institutions, governments, and everyday users are all adjusting to a world where digital currencies dominate.

But for mass adoption to happen, people need an easy way to get started.

Crypto faucets are solving that problem.

By providing free stablecoins, faucets are removing financial barriers and giving millions of users their first exposure to digital assets. They are also teaching essential skills, like setting up wallets, making transactions, and earning passive income through DeFi.

As regulations evolve and institutions integrate stablecoins, faucets will continue to empower users, ensuring that financial access and education remain open to everyone—regardless of background, location, or income level.

The future of finance isn’t just digital—it’s decentralised. And crypto faucets are making sure that everyone gets a chance to be part of it.