Let’s face it: Decentralised finance (DeFi) is complicated. For everyday users, the promise of DeFi is tempting—earning passive income, taking out Bitcoin-backed loans, or staking crypto for rewards. But here’s the problem: getting started is often expensive and confusing.

High entry costs for buying Bitcoin and a lack of knowledge about how DeFi works have left most people sitting on the sidelines, watching from a distance.

The Problem: Retail Users Are Left Behind

Big institutions and wealthy investors are scooping up the benefits of DeFi. Why?

Because they can afford to buy Bitcoin and navigate the complexities of staking, lending, and liquidity pools.

But what about the average person who doesn’t have thousands of dollars lying around to invest in Bitcoin? Or the underserved populations who don’t even have access to a reliable banking system, let alone DeFi?

They get left out.

The Solution: Bitcoin Faucets

That’s where Bitcoin faucets come in. Think of them as entry-level tools for financial innovation. They let users earn micro Bitcoin reserves—tiny amounts of Bitcoin (known as satoshis)—just by completing simple tasks.

Here’s what makes faucets special:

- They’re risk-free. You don’t need to invest your own money.

- They’re educational. Faucets teach you how Bitcoin works, how to secure wallets, and how blockchain transactions happen.

- They’re empowering. Over time, you can accumulate enough Bitcoin to explore DeFi tools like staking or loans.

In short, faucets remove the financial and knowledge barriers that keep most people out of the DeFi game.

Key Things to Know:

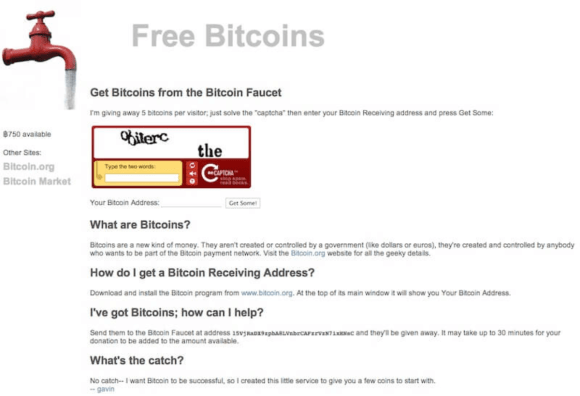

- What is a Bitcoin Faucet? It’s a platform that rewards users with small amounts of Bitcoin (satoshis) for completing tasks like solving captchas, playing games, or answering quizzes.

- Why Do Faucets Matter? They allow users to build Bitcoin reserves without spending money, making DeFi accessible to retail users and underserved populations.

- How Are Faucets Educational? They introduce users to blockchain basics, wallet security, and how to interact with DeFi platforms.

How Bitcoin Faucets Work

What Are Bitcoin Faucets?

A Bitcoin faucet is a website or app that rewards users with tiny amounts of Bitcoin, known as satoshis (the smallest unit of Bitcoin), for completing simple tasks. These tasks can be as easy as solving captchas, clicking ads, playing games, or answering quizzes.

The idea is simple: You earn small Bitcoin rewards without needing to spend your own money. It’s like dipping your toes into the world of Bitcoin without any risk.

The concept of Bitcoin faucets dates back to 2010 when Bitcoin developer Gavin Andresen launched the first faucet. His goal? To introduce people to Bitcoin by literally giving it away. Fast forward to today, and faucets remain one of the most accessible entry points into the cryptocurrency space.

How Do Bitcoin Faucets Reward Users?

Here’s the process:

- Register on a faucet platform: You’ll need a Bitcoin wallet to collect your earnings.

- Complete small tasks: These can range from solving captchas, playing a game, taking a quiz, or even watching an ad.

- Earn satoshis: Once you finish the task, the faucet rewards you with a tiny fraction of Bitcoin.

- Withdraw to your wallet: After accumulating enough satoshis, you can withdraw your earnings to a Bitcoin wallet.

Faucets are free, but they make money through advertising. The ads you see while completing tasks generate revenue for the platform, which is then shared with users in the form of Bitcoin rewards.

Popular Bitcoin Faucets

There are hundreds of Bitcoin faucets out there, but a few stand out as reliable, user-friendly, and educational:

Cointiply

- What it does: Cointiply offers a variety of ways to earn Bitcoin, including completing surveys, watching videos, and playing games.

- Why it’s popular: It integrates gamified features like loyalty bonuses and leaderboards to keep users engaged.

FreeBitco.in

- What it does: FreeBitco.in allows users to earn Bitcoin by playing games, entering lotteries, and claiming free satoshis every hour.

- Unique feature: Users can also earn interest on their Bitcoin by keeping it on the platform.

Bitcoinker

- What it does: This faucet focuses on simplicity, offering Bitcoin rewards for solving captchas.

- Why it’s great for beginners: Its straightforward approach makes it perfect for users who want to start earning Bitcoin without any complications.

Faucets: A Risk-Free Introduction to Earning Bitcoin

Unlike buying Bitcoin, which requires upfront investment, faucets let you earn Bitcoin without risking your own money. This makes them a perfect starting point for beginners who want to:

- Learn about blockchain and Bitcoin in a hands-on way.

- Build micro Bitcoin reserves over time.

- Transition into exploring more complex DeFi tools, like staking or loans, once they’ve accumulated enough Bitcoin.

Faucets also play an important role in blockchain literacy. They teach users how to set up wallets, secure their private keys, and send/receive Bitcoin—all critical skills for navigating the broader cryptocurrency ecosystem.

Why Gamification Matters

Platforms like Cointiply and FreeBitco.in use gamified learning to keep users engaged. This means you’re not just earning Bitcoin—you’re having fun while learning valuable skills. For example:

- Quizzes: Teach users about blockchain basics.

- Leaderboards: Motivate users to compete and earn more Bitcoin.

- Daily bonuses: Encourage users to interact with the platform consistently.

By combining education with entertainment, Bitcoin faucets make the process of earning and learning both accessible and enjoyable.

Key Takeaway:

Bitcoin faucets are a risk-free, fun, and educational way to earn Bitcoin. They introduce users to the cryptocurrency world while teaching the fundamentals of blockchain and wallets. Over time, these micro earnings can open the door to advanced DeFi tools like staking, liquidity pools, or Bitcoin-backed loans.

The Role of Micro Bitcoin Reserves in DeFi

Gradual Accumulation of Bitcoin

Earning Bitcoin doesn’t have to involve expensive investments or technical know-how. Through Bitcoin faucets, users can gradually accumulate satoshis over time by completing simple tasks.

This approach eliminates financial risks for users who may be hesitant or unable to purchase Bitcoin outright. Instead, faucets allow them to build small Bitcoin reserves, which can later be used to explore decentralised finance (DeFi) tools.

- Stat to Know: Since their inception, Bitcoin faucets have distributed over 200,000 BTC globally, demonstrating their impact in enabling retail participation in Bitcoin and DeFi.

- Example: A user who starts with Cointiply could accumulate enough Bitcoin over several months to eventually begin staking or exploring liquidity pools in the DeFi space.

These micro Bitcoin holdings may not seem like much initially, but over time, they open the door to accessing financial opportunities that were previously out of reach for retail users.

Unlocking DeFi Opportunities with Micro Bitcoin Reserves

Once users have accumulated enough Bitcoin through faucets, they gain access to the expansive ecosystem of DeFi tools, such as:

1. Staking

- Users can lock up their Bitcoin (or tokenised versions like wBTC) on platforms like Binance or Lido to earn interest.

- Staking offers a passive income stream for users while contributing to the security of blockchain networks.

2. Bitcoin-Backed Loans

- Platforms like Unchained Capital and Ledn allow users to leverage their Bitcoin holdings as collateral for fiat or stablecoin loans.

- This is particularly useful for users who need liquidity but don’t want to sell their Bitcoin.

- Stat to Know: Bitcoin-backed loans grew by 40% year-over-year (2022–2023), as more users began leveraging their Bitcoin reserves for financial flexibility.

3. Liquidity Pools and Yield Farming

- Micro Bitcoin reserves can also be used on decentralised exchanges (DEXs) to provide liquidity and earn transaction fees or farming rewards.

- Examples include platforms like Uniswap, which supports tokenised Bitcoin pairs like wBTC/ETH.

By turning small Bitcoin holdings into active investments, retail users can participate in a global decentralised financial system, even if they started with nothing but faucet rewards.

Financial Inclusion in Underserved Regions

Faucets play a particularly critical role in regions where traditional financial systems are either unstable or inaccessible.

1. Addressing Hyperinflation

- In countries like Venezuela and Argentina, hyperinflation has devastated the value of local currencies.

- Bitcoin offers a hedge against these challenges, allowing users to preserve wealth and transact globally without relying on unstable fiat systems.

- Example: Venezuelan users have turned to faucets like FreeBitco.in to accumulate Bitcoin, which they then use for cross-border payments or savings.

2. Serving the Unbanked Population

- Across Africa, where 40% of the population is unbanked, Bitcoin faucets are bridging the gap.

- Faucets give users access to the global economy without requiring a traditional bank account.

3. Stat to Know:

Bitcoin adoption in Latin America doubled between 2021 and 2023, driven by the need for alternatives to unreliable financial systems. Faucets have played a key role in onboarding users from these regions into the Bitcoin and DeFi ecosystems.

Micro Bitcoin Reserves as a Catalyst for DeFi Adoption

The significance of micro Bitcoin reserves lies in their ability to level the financial playing field. They democratise access to DeFi by allowing anyone—regardless of their financial situation—to participate in staking, lending, or liquidity provision.

Key Takeaway: Faucets are more than just a way to earn Bitcoin; they’re onboarding tools that teach users how to save, invest, and utilise Bitcoin in a decentralised financial system.

Faucets as Educational Tools for DeFi Onboarding

Teaching Blockchain Basics

Getting into Bitcoin and DeFi for the first time can feel overwhelming. Wallets, private keys, transactions, staking—there’s a lot to learn. That’s where faucets come in.

Bitcoin faucets serve as low-risk “training grounds” for retail users, helping them build foundational blockchain knowledge while earning small Bitcoin rewards.

Here’s what faucets teach users:

- Wallet Security:

- Faucets require users to create and connect a Bitcoin wallet, teaching them how to manage their private keys and understand wallet interfaces.

- This hands-on approach reduces the risk of mistakes later, such as losing funds or falling victim to scams.

- Blockchain Transactions:

- When withdrawing earnings from a faucet, users learn how blockchain transactions work—how to send, receive, and verify Bitcoin transfers on the network.

- These practical experiences demystify the process and build user confidence.

- Staking and Beyond:

- Some faucets, like FreeBitco.in, introduce users to staking by offering interest on their Bitcoin balances.

- Users gradually learn how staking works, which prepares them to explore more advanced DeFi opportunities in the future.

In short, faucets simplify blockchain concepts through real-world interactions, making it easier for beginners to gain confidence in managing cryptocurrency.

Gamification Drives Learning

Let’s be real: Nobody wants to sit through a dry tutorial on Bitcoin or DeFi. That’s why successful faucet platforms incorporate gamification, turning education into an engaging and fun experience.

Key Gamified Features of Faucets:

- Quizzes:

- Faucets like Cointiply reward users with satoshis for completing quizzes on blockchain basics, teaching concepts like wallet security, staking, and DeFi tools.

- Leaderboards:

- Platforms often feature leaderboards to create friendly competition, motivating users to complete more tasks and learn as they go.

- Daily Bonuses and Streaks:

- Faucets reward consistent engagement with daily streak bonuses, ensuring users stay active while gradually picking up blockchain knowledge.

- NFT-Based Rewards:

- Some faucets have started integrating NFTs into their reward systems, allowing users to earn digital collectibles alongside Bitcoin. These NFTs can be traded or used for perks within the platform.

Why It Works:

Gamification keeps users engaged, making it easier for them to retain information and stay motivated. Instead of passively reading about blockchain, users actively participate, which helps bridge the gap between learning and doing.

Stat to Know:

According to a survey conducted by Cointiply, 78% of their users claimed that faucets were their first exposure to Bitcoin, highlighting the power of gamified learning platforms in introducing new users to crypto.

Bridging the Knowledge Gap

The knowledge gap is one of the biggest barriers to DeFi adoption. Without a solid understanding of blockchain fundamentals, many users are hesitant to dive into staking, liquidity pools, or Bitcoin-backed loans.

Faucets help bridge this gap by preparing users to engage confidently with DeFi tools. Here’s how:

- Practical Hands-On Experience:

- By interacting with faucets, users gain real-world experience in wallet management, transactions, and earning Bitcoin.

- This reduces the fear of making mistakes when they later interact with DeFi platforms.

- DeFi Concepts Made Simple:

- Faucets often integrate simple tutorials or FAQs to explain staking, liquidity pools, and tokenised Bitcoin.

- For example, a user who starts earning Bitcoin on a faucet may later learn how to use it for staking on platforms like Binance.

- Transitioning to Advanced DeFi:

- Once users have a grasp of the basics, they are better equipped to explore more complex tools like yield farming, Bitcoin-backed loans, or decentralised exchanges.

By lowering the learning curve, faucets empower users to move from passive earners to active participants in the DeFi ecosystem.

Why Faucets Matter for DeFi Onboarding

Faucets aren’t just about earning small Bitcoin rewards—they’re about building confidence and literacy. By combining education with gamification, they create an environment where users can learn by doing. Over time, this prepares them to participate in DeFi tools that once felt intimidating.

Key Takeaway: Faucets are powerful onboarding tools for DeFi. They teach blockchain basics, engage users through gamified learning, and help bridge the knowledge gap so that anyone, regardless of experience, can confidently navigate decentralised finance.

Democratising Access to DeFi

Overcoming Entry Barriers

For most people, the biggest hurdle to participating in DeFi isn’t understanding the technology—it’s affordability. Owning Bitcoin, the most recognised digital asset, often requires upfront capital, which can feel unattainable for retail users or people in underserved regions.

Here’s the truth: DeFi can’t succeed without accessibility. If participation is limited to institutions and wealthy investors, it defeats the purpose of decentralisation.

That’s where Bitcoin faucets come in. They democratise access to decentralised finance by enabling anyone to earn small amounts of Bitcoin (satoshis) without spending money.

How Bitcoin Faucets Empower Underserved Populations:

- No Upfront Cost:

- Faucets allow users to start their Bitcoin journey with zero investment, breaking down financial barriers.

- Accessible in Low-Income Regions:

- In areas with limited banking infrastructure, faucets provide a direct path to Bitcoin ownership without requiring credit cards or bank accounts.

- Introduction to DeFi:

- With even a small reserve of Bitcoin, users can experiment with staking, lending, and other DeFi tools. Over time, they gain both financial and technological empowerment.

Key Point: Faucets are not just about earning Bitcoin—they’re about opening doors to financial opportunities for people who were previously locked out.

Real-Life Case Studies

1. Nigerian Users Adopting Bitcoin Wallets

In Nigeria, where 40% of the population remains unbanked, Bitcoin has emerged as a lifeline. The local currency, the naira, faces significant inflation, and banking systems often fail to meet the needs of the people.

Here’s how Bitcoin faucets are making a difference:

- Unbanked Users Gain Financial Access: Platforms like Bitcoinker allow Nigerians to earn Bitcoin in small amounts, providing an entry point to the global economy without needing a traditional bank account.

- Empowering Financial Independence: By earning satoshis through faucets, users can save in Bitcoin instead of volatile local currency, preserving their wealth over time.

This trend has contributed to Nigeria being ranked as one of the top countries for Bitcoin adoption globally. Faucets play a pivotal role in onboarding users who wouldn’t otherwise participate in crypto or DeFi.

2. Latin America: Tackling Economic Instability with Bitcoin Faucets

In countries like Venezuela and Argentina, where hyperinflation has decimated the value of fiat currencies, Bitcoin offers a lifeline for economic stability.

The Impact of Faucets:

- Venezuelan Users:

- Venezuelans use faucets like FreeBitco.in to earn Bitcoin and preserve value against a currency that loses purchasing power daily.

- These micro Bitcoin earnings often go towards essential purchases, remittances, or savings.

- Argentina:

- In Argentina, where inflation reached 124% in 2023, Bitcoin faucets are one of the few tools people can use to access a stable and decentralised store of value.

Stat to Know: Between 2021 and 2023, Bitcoin adoption in Latin America doubled, largely driven by the need to hedge against unreliable financial systems. Faucets serve as an accessible gateway for retail users in these regions to escape economic instability and explore DeFi.

Democratizing Finance, One Satoshi at a Time

By enabling users to earn Bitcoin without financial risk, faucets are levelling the playing field in ways that traditional finance never could. Whether it’s helping a Nigerian farmer access a global financial system or enabling a Venezuelan student to save in Bitcoin, faucets empower grassroots adoption of DeFi.

Key Takeaway: Faucets are not just tools for earning Bitcoin; they are engines for financial inclusion, helping underserved populations break into the decentralised economy and unlock opportunities that were previously out of reach.

The Future of Bitcoin in DeFi

Expanding Bitcoin’s Utility

Bitcoin’s original purpose was simple: to serve as a decentralised currency. Over time, its role has evolved far beyond digital cash. Today, Bitcoin has become a key asset in decentralised finance (DeFi), unlocking new use cases and financial opportunities for users worldwide.

1. Bitcoin as Collateral for Loans

Bitcoin is increasingly used as collateral on platforms like Unchained Capital and Ledn, allowing users to borrow fiat or stablecoins without selling their Bitcoin holdings.

- Why it works: Bitcoin’s status as the most secure and widely recognised cryptocurrency makes it an ideal collateral asset.

- Real-world example: A user with micro Bitcoin reserves earned from faucets could leverage their holdings to secure a Bitcoin-backed loan, providing liquidity without forfeiting their crypto assets.

2. Yield-Generating Tools

DeFi platforms now offer ways to earn passive income using Bitcoin:

- Staking and Lending: Users can lock their Bitcoin in lending pools to earn interest.

- Liquidity Mining: By contributing Bitcoin to liquidity pools, users can earn rewards in the form of trading fees or governance tokens.

3. Emerging Trends: Tokenised Bitcoin in DeFi

One of the most exciting trends in DeFi is tokenised Bitcoin, such as Wrapped Bitcoin (wBTC) and RenBTC, which bring Bitcoin to Ethereum and other blockchain ecosystems.

- Tokenised Bitcoin can be used for:

- Yield farming: Generating additional rewards on decentralised exchanges (DEXs) like Uniswap or PancakeSwap.

- Decentralised lending: Platforms like Aave and Compound enable users to lend or borrow using tokenised Bitcoin.

- Why it matters: Tokenization bridges the gap between Bitcoin and other DeFi ecosystems, allowing Bitcoin holders to tap into advanced financial tools.

Key Insight: Bitcoin’s utility in DeFi is expanding rapidly. Faucets, while seemingly simple, are introducing millions of users to the foundational asset of this financial revolution, setting them up to participate in these advanced use cases.

Preparing Retail Users for the Next Wave of Financial Innovation

As Bitcoin’s role in DeFi grows, retail users need to be prepared to navigate and benefit from these new opportunities. This is where faucets play a critical role in onboarding and education.

1. Faucets as the First Step

Faucets act as a stepping stone, introducing users to Bitcoin in a low-risk, hands-on way. With even a small amount of Bitcoin earned through faucets, users can begin exploring:

- Staking opportunities: Platforms like Binance or Lido offer easy-to-access staking tools.

- Decentralised exchanges: Tokenized Bitcoin can be used to swap assets or earn fees on platforms like Uniswap.

- Lending and borrowing: Bitcoin-backed loans offer financial flexibility to users who want to preserve their holdings while accessing liquidity.

2. Gamification and Education Drive Widespread Adoption

Faucet platforms like Cointiply have shown that gamification works to keep users engaged while teaching them about DeFi. By integrating features like quizzes, daily challenges, and leaderboards, faucets:

- Boost financial literacy: Users learn about wallets, staking, and blockchain basics in an interactive way.

- Build confidence: Gamified faucets reduce the intimidation factor of DeFi by making the learning process fun and incremental.

3. The Power of Grassroots Onboarding

Unlike institutions, which onboard users through complex products, faucets onboard users at the grassroots level. This democratised approach ensures that:

- More retail users participate: Faucets introduce millions to Bitcoin, opening up DeFi access on a global scale.

- Adoption becomes inclusive: By lowering both financial and knowledge barriers, faucets ensure that underserved populations aren’t left behind in this financial transformation.

Key Insight: Faucets are not just onboarding tools; they are building blocks for the next wave of financial innovation. They prepare users for DeFi by giving them the knowledge, confidence, and starting capital needed to participate meaningfully in a decentralised economy.

The Bigger Picture: Bitcoin’s Future in DeFi

As DeFi continues to evolve, Bitcoin’s utility will only grow:

- It will remain a cornerstone asset for collateralised loans, staking, and tokenised assets.

- Its integration with other blockchains through tools like wBTC will expand its reach beyond the Bitcoin network.

- Faucets will serve as onboarding engines, ensuring that millions of users can actively participate in this evolving financial landscape.

Key Takeaway: Faucets are more than just tools for earning Bitcoin—they are gateways to the future of decentralised finance, giving everyday users the foundation they need to thrive in a rapidly changing economy.

Conclusion

Bitcoin Faucets: Transforming Financial Access

Bitcoin faucets have proven to be far more than just simple reward systems—they are transformative tools for financial inclusion. By allowing users to earn micro Bitcoin reserves without any financial risk, faucets:

- Lower barriers to entry into the world of cryptocurrency and decentralised finance (DeFi).

- Serve as educational platforms, teaching blockchain basics like wallet security, transactions, and staking.

- Act as onboarding tools, preparing retail users to engage with advanced DeFi opportunities like staking, liquidity pools, and Bitcoin-backed loans.

For underserved populations, faucets provide a critical gateway to financial freedom. In regions like Nigeria or Venezuela, where traditional systems fail to meet the needs of the people, Bitcoin faucets empower individuals to participate in a global decentralised economy.

Laying the Foundation for Grassroots Financial Empowerment

The future of decentralised finance is clear: Bitcoin will remain a cornerstone asset, driving innovation in areas like tokenised Bitcoin (wBTC), yield farming, and collateralised lending. However, the key to unlocking this future lies in grassroots adoption—and that’s exactly where faucets excel.

With continued advancements in gamified learning platforms and Bitcoin-backed financial tools, faucets are bridging the gap between the unbanked and the decentralised world. They’re not just giving out satoshis—they’re planting the seeds of financial literacy, inclusion, and empowerment.

Final Thought:

As Bitcoin’s utility in DeFi grows, faucets will continue to play a vital role in democratising financial innovation, ensuring that anyone, regardless of income or location, can participate in this revolutionary ecosystem. The journey to financial empowerment starts with a single satoshi—and Bitcoin faucets are lighting the way.