Governments around the globe are waking up to the potential of cryptocurrencies.

National cryptocurrency strategies are being drafted to position countries at the forefront of this financial revolution. These plans often focus on institutional adoption, such as building digital asset reserves or integrating blockchain into public systems.

But here’s the problem: Grassroots adoption is often overlooked.

Without empowering individuals, especially those in underserved or underbanked communities, these strategies risk becoming one-sided. To build a truly inclusive blockchain economy, we need to ensure everyone—regardless of income or education—has access to cryptocurrency.

That’s where crypto faucets lists come in.

By distributing small amounts of Bitcoin or other cryptocurrencies for completing simple tasks, crypto faucets offer a low-risk, hands-on introduction to the blockchain economy. They’re easy to use, effective at educating newcomers, and uniquely suited for reaching everyday people who might otherwise miss out.

In this article, we’ll explore how crypto faucets bridge the gap between institutional progress and retail inclusion, becoming a powerful tool for national cryptocurrency strategies.

The Role of Crypto Faucets in Grassroots Adoption

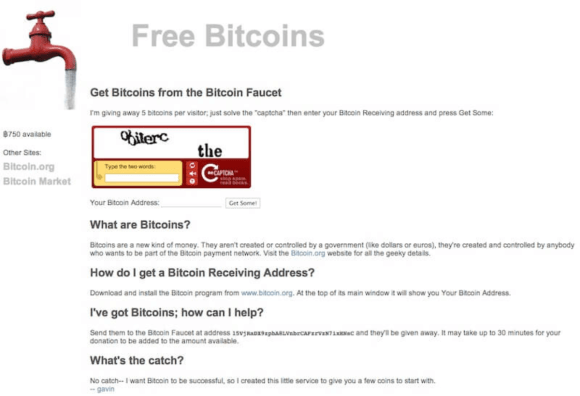

Crypto faucets are free platforms that reward users with tiny amounts of Bitcoin or other cryptocurrencies. They’ve been around since Bitcoin’s early days, starting with the original Bitcoin Faucet created by Gavin Andresen in 2010, which gave away 5 BTC to anyone willing to try it.

Although 5 BTC might sound like a fortune now, the idea was simple: Let people experience Bitcoin firsthand to encourage adoption.

Fast forward to today, and faucets are still playing the same role, but they’ve evolved. Modern faucets aren’t just giveaways—they’re education hubs that teach users about blockchain basics while distributing rewards.

How Crypto Faucets Work

At their core, crypto faucets operate on a simple principle: earn while you learn. Users complete small tasks or actions, such as:

- Solving CAPTCHAs.

- Watching videos or advertisements.

- Participating in quizzes or challenges about cryptocurrency.

In return, they receive micro-rewards in crypto. While the amounts are small, the impact is massive. Faucets introduce millions of people to cryptocurrency without requiring upfront investments.

Key Things to Know

- Micro Bitcoin Reserves: Faucets help users build small crypto balances at zero cost, providing them a stepping stone into the blockchain economy.

- Risk-Free Onboarding: Users don’t have to buy crypto to learn how it works. Faucets offer a free and accessible starting point.

- Hands-On Education: Most faucets double as learning tools, teaching users about wallets, blockchain transactions, and DeFi in a practical way.

- Scalability: With internet access and a smartphone, anyone in the world can participate, making faucets a global tool for financial inclusion.

Crypto faucets are more than just an entry point—they’re the foundation for grassroots crypto adoption, ensuring that individuals can take their first step toward participating in the blockchain economy.

In the next section, we’ll dive deeper into how faucets promote financial inclusion, especially for underbanked communities. From tackling barriers to entry to empowering underserved regions, faucets are reshaping how people engage with cryptocurrency.

The Role of Crypto Faucets in Grassroots Adoption

What Are Crypto Faucets?

A crypto faucet is a platform that rewards users with small amounts of cryptocurrency, often referred to as “micro Bitcoin reserves,” in exchange for completing simple tasks. Think of it as a digital version of a rewards program—but instead of points, you’re earning crypto.

The term “faucet” comes from the idea of a dripping tap: just like water slowly trickling out, faucets distribute tiny amounts of crypto over time. These rewards might seem small, but for someone new to crypto, they’re a perfect way to learn the basics without risking personal funds.

A Brief History of Crypto Faucets

Crypto faucets date back to the early days of Bitcoin. In 2010, Gavin Andresen, one of Bitcoin’s core developers, created the first-ever Bitcoin faucet. The purpose? To encourage adoption of Bitcoin by letting people experience it firsthand.

At the time, Andresen’s faucet gave away 5 BTC per claim—a staggering amount by today’s standards, but back then, Bitcoin had little to no monetary value. His faucet introduced countless people to Bitcoin, making it a foundational tool for early grassroots adoption.

Since then, faucets have grown into a global phenomenon, used by millions of people worldwide. Today, they’re more than just giveaways—they’re interactive platforms that combine education, engagement, and rewards to onboard retail users to the crypto ecosystem.

Examples of Popular Crypto Faucets

Modern crypto faucets have evolved in functionality and scale. Here are some of the most popular platforms driving grassroots adoption:

FreeBitco.in:

- One of the largest and most trusted Bitcoin faucets globally, with over 47 million registered users.

- Users can earn Bitcoin by rolling the faucet, participating in lottery games, or staking crypto.

Cointiply:

- Known for its wide range of tasks, from solving CAPTCHAs to completing surveys and playing games.

- Offers a user-friendly dashboard and bonus rewards for active participants.

FireFaucet:

- A multi-crypto faucet that allows users to earn various cryptocurrencies, including Bitcoin, Ethereum, and Litecoin.

- Automates rewards once users meet specific activity levels, making it a favourite among faucet enthusiasts.

These faucets have successfully introduced millions of users to cryptocurrency, making them a key part of grassroots adoption strategies.

How Crypto Faucets Work

At their core, faucets operate on a simple task-reward mechanism. Users perform easy, low-effort actions in exchange for small amounts of cryptocurrency. Here’s how it works step-by-step:

- Sign Up:

- Users register with their email and set up a cryptocurrency wallet to receive rewards.

- Perform Tasks:

- Typical tasks include solving CAPTCHAs, watching ads or videos, completing surveys, or playing mini-games.

- Some faucets, like Cointiply, also incorporate educational tasks like quizzes about crypto basics.

- Claim Rewards:

- Upon completing tasks, users can claim rewards in micro amounts of crypto. These payouts are often measured in satoshis (the smallest unit of Bitcoin).

- For example, a faucet might reward 10–100 satoshis per task.

- Build Micro Bitcoin Reserves:

- Over time, users accumulate small balances in their wallets. While the amounts may not be life-changing, they serve as an introduction to the blockchain economy.

Why Crypto Faucets Matter

Crypto faucets go beyond just free rewards—they’re practical tools that:

- Introduce Users to Crypto: By earning Bitcoin in small amounts, users gain hands-on experience with wallets, transactions, and blockchain basics.

- Promote Financial Inclusion: Faucets provide free access to cryptocurrency, making it possible for people without financial means to participate.

- Educate Through Experience: Completing tasks helps users learn while earning, creating a low-pressure environment to explore crypto.

Crypto faucets, once dismissed as a niche tool, are now pioneering grassroots adoption efforts by lowering entry barriers and empowering individuals to engage with the blockchain economy.

In the next section, we’ll discuss how crypto faucets promote financial inclusion, focusing on their role in empowering underbanked communities and providing accessible entry points into the blockchain economy.

Crypto Faucets and Financial Inclusion

Cryptocurrency is often hailed as a tool for financial inclusion, and crypto faucets are at the heart of making this vision a reality. By eliminating the barriers to entry, faucets provide an accessible, risk-free way for individuals—especially in underserved and underbanked communities—to engage with blockchain technology and begin building wealth in the digital economy.

Tackling Barriers to Entry

One of the biggest challenges for people new to cryptocurrency is the cost of entry. Many are hesitant to purchase Bitcoin or other cryptocurrencies due to a lack of understanding, distrust of the technology, or limited financial resources.

Crypto faucets solve this problem by allowing users to earn small amounts of Bitcoin or other tokens without spending any money. Here’s why this matters:

- Eliminating Financial Risk:

- For someone who doesn’t fully understand how crypto works, faucets act as a “free trial” for the blockchain economy.

- Instead of requiring upfront investment, users can experiment with crypto in a low-stakes environment.

- Building Micro Bitcoin Reserves:

- Faucets help users accumulate small balances of Bitcoin or other cryptocurrencies over time.

- Even if these balances are small, they serve as a gateway to the broader crypto ecosystem, giving users something to hold, manage, and potentially grow.

- Empowering Underserved Communities:

- For people in developing countries or underbanked regions, faucets are often the first step to financial independence in the digital economy.

- With just a smartphone and internet access, users can start participating in the crypto ecosystem—no bank account needed.

By reducing these barriers, crypto faucets make blockchain technology more inclusive, providing opportunities for individuals who would otherwise be excluded from the financial system.

Faucets as an Access Point for the Unbanked

The unbanked population—people without access to traditional financial services like bank accounts or credit cards—represents a massive untapped market for cryptocurrency adoption. According to the World Bank’s 2023 Global Findex Database, 1.4 billion people worldwide are unbanked, with the majority living in developing countries.

For these individuals, crypto faucets are more than just a tool—they’re a lifeline to financial inclusion.

Why Faucets Matter for the Unbanked:

- No Need for a Bank Account:

- Faucets only require a smartphone and an internet connection, making them accessible to nearly anyone, even in remote areas.

- Low Barriers to Start:

- Faucets offer free access to Bitcoin and other cryptocurrencies, giving unbanked individuals a way to join the digital economy without needing traditional financial infrastructure.

- Education Built In:

- Many faucets teach users about crypto wallets and blockchain transactions as part of their reward systems, empowering the unbanked with both knowledge and resources.

Case Study: Nigeria’s Crypto Adoption Surge

Nigeria is a powerful example of how grassroots tools like faucets can drive crypto adoption in underbanked communities.

- Rapid Growth in Crypto Usage:

- Nigeria ranks among the top countries for cryptocurrency adoption, with over 35% of adults reporting they’ve used or owned cryptocurrency (Chainalysis, 2023).

- This surge is driven by financial instability, limited banking access, and a youthful population eager to explore digital alternatives.

- Role of Grassroots Tools:

- Crypto faucets, alongside mobile wallets and peer-to-peer exchanges, have been instrumental in educating Nigerians about blockchain technology.

- By earning Bitcoin through faucets, individuals are able to save, transact, and participate in the global digital economy without relying on traditional banks.

- Empowering Everyday Users:

- Faucets provide a simple entry point for young Nigerians who are otherwise excluded from global financial systems.

- These tools have also inspired greater curiosity about blockchain, DeFi, and digital payments, positioning Nigeria as a leader in grassroots crypto adoption.

Why This Matters for National Crypto Strategies

For countries looking to implement a national cryptocurrency strategy, faucets offer a proven way to:

- Onboard Underserved Populations: By addressing the needs of the unbanked, faucets ensure that no one is left behind in the transition to digital finance.

- Drive Widespread Adoption: The grassroots approach of faucets complements institutional efforts, creating a balanced ecosystem where both governments and individuals benefit.

- Empower Local Economies: By giving people access to crypto, faucets help drive economic participation and independence in regions where traditional financial systems are failing.

Crypto faucets don’t just tackle barriers—they tear them down, opening the door for millions to participate in a blockchain-powered economy.

In the next section, we’ll explore how faucets act as educational platforms, teaching users the fundamentals of blockchain, wallet management, and decentralised finance (DeFi). Through these tools, people gain the skills they need to thrive in the digital economy.

Educating Users Through Crypto Faucets

While crypto faucets are often seen as a way to earn small amounts of Bitcoin or other cryptocurrencies, their true value lies in the education they provide. Faucets don’t just give users free crypto—they teach them how to use it. By offering hands-on learning opportunities, faucets act as educational platforms, equipping users with the knowledge and skills they need to navigate the blockchain economy.

Teaching Blockchain Basics

For someone new to cryptocurrency, the blockchain world can feel intimidating. Crypto faucets simplify the learning process by breaking it down into manageable steps. Here’s how they teach the fundamentals:

- Secure Wallet Setup and Management

- One of the first things users learn through faucets is how to set up a crypto wallet.

- Faucets often guide users step-by-step, teaching them how to:

- Create a wallet address to receive payouts.

- Safely store private keys and recovery phrases.

- Protect their wallets from phishing attacks and fraud.

- This hands-on approach helps users understand the importance of wallet security, which is a critical skill for anyone entering the crypto space.

- Understanding Transactions

- Faucets introduce users to the mechanics of blockchain transactions:

- How to send and receive Bitcoin or other cryptocurrencies.

- Transaction fees and how they work.

- Viewing transaction details on blockchain explorers (e.g., confirming hash IDs).

- This knowledge demystifies the blockchain and helps users see it as a practical tool rather than an abstract concept.

- Faucets introduce users to the mechanics of blockchain transactions:

- Decentralised Finance (DeFi)

- Many modern faucets go beyond basic crypto education by introducing users to DeFi concepts, such as:

- Staking: Earning passive income by locking up crypto in a smart contract.

- Lending and Borrowing: Using platforms like Aave or Compound.

- Yield Farming: Maximising returns through liquidity pools.

- Faucets that include DeFi tools (or quizzes about them) ensure that users understand how to maximise the utility of their crypto rewards.

- Many modern faucets go beyond basic crypto education by introducing users to DeFi concepts, such as:

By focusing on these basics, faucets provide users with a practical and actionable foundation for participating in the blockchain economy.

Case Study: Coinbase Earn’s Success

One of the most successful examples of a crypto platform combining education with rewards is Coinbase Earn.

- What Is Coinbase Earn?

- Coinbase Earn is an educational initiative that pays users to learn about different cryptocurrencies and blockchain technologies.

- Participants watch short video tutorials and complete quizzes to earn free crypto.

- Impact:

- Between 2021 and 2023, Coinbase Earn onboarded over 1 million users globally.

- The program distributed millions of dollars in crypto rewards while teaching users about blockchain projects, such as Compound (COMP) and Stellar (XLM).

- Why It Works:

- Combining financial incentives with education keeps users engaged.

- The program focuses on delivering digestible, beginner-friendly content, making crypto concepts accessible to a wide audience.

Coinbase Earn’s success highlights the potential of combining rewards with education—a principle that crypto faucets have been using for years.

Integration of Gamified Learning Tools in Faucets

Modern faucets have taken education a step further by incorporating gamification. This approach makes learning more interactive and fun, increasing user retention and engagement. Here are two examples:

Pipeflare:

- Pipeflare is a multi-crypto faucet that gamifies the earning process.

- Users complete challenges, play blockchain-based games, and earn rewards while learning about crypto.

The platform even offers bonus rewards for completing educational tasks, like setting up a wallet or exploring new blockchain tools.

Satoshi Hero:

- Satoshi Hero rewards users for completing quizzes and tasks related to blockchain education.

- The faucet integrates leaderboard competitions, encouraging users to stay active while learning.

By offering engaging content and gamified features, Satoshi Hero keeps users invested in the learning process.

Why Education Through Faucets Matters

Crypto faucets go beyond just giving away free Bitcoin—they’re building a crypto-literate population. By teaching users the basics of blockchain, wallets, and DeFi, faucets empower individuals to participate confidently in the crypto economy.

This educational role aligns perfectly with the goals of national cryptocurrency strategies, which require a knowledgeable and engaged population to drive widespread adoption.

In the next section, we’ll explore gamification as a driver for crypto adoption, looking at how interactive features like quizzes, competitions, and NFT-based rewards sustain user engagement and make learning about blockchain enjoyable.

Gamification as a Driver for Adoption

In the world of crypto faucets, gamification has emerged as a powerful tool for onboarding and educating users. By combining learning with fun, gamified faucets turn earning and understanding cryptocurrency into an interactive experience that keeps users engaged. Gamification is more than just a buzzword—it’s a strategy that’s proven to boost participation, retention, and user satisfaction, making it a critical component of grassroots crypto adoption efforts.

What Is Gamified Crypto Learning?

Gamified crypto learning involves integrating game-like elements into the earning and educational experience. Instead of simply handing out free crypto for clicking a button, gamified faucets encourage users to complete tasks, solve problems, and compete with others. These tasks are designed not just to entertain but also to educate users about blockchain, cryptocurrency, and decentralised finance (DeFi).

How Gamification Works in Crypto Faucets

Modern faucets have transformed into engaging platforms that include features such as:

- Quizzes

- Users answer questions about blockchain basics, wallet management, or DeFi concepts to earn rewards.

- This approach ensures that users actively learn while earning, reinforcing key concepts through repetition.

- Challenges and Tasks

- Tasks might include setting up a secure wallet, exploring a specific blockchain, or interacting with decentralised applications (dApps).

- Completing these challenges not only rewards users with crypto but also builds their confidence in navigating the blockchain ecosystem.

- Leaderboards and Competitions

- Faucets like Satoshi Hero and Pipeflare use leaderboards to incentivise consistent participation.

- Users earn points for completing tasks or quizzes and compete for bonus rewards.

- This sense of competition fosters engagement and creates a community around the faucet platform.

- NFT-Based Rewards

- Some faucets, such as Pipeflare, have incorporated NFT rewards alongside crypto payouts.

- Users can earn collectable digital assets for completing tasks or hitting milestones, giving them an additional incentive to stay active.

- NFTs also serve as an introduction to Web3 concepts, helping users explore new blockchain applications.

Examples of Gamified Faucets

Here are two standout examples of faucets that effectively use gamification to drive adoption:

- Pipeflare

- Offers users crypto rewards for playing blockchain-based games and completing daily challenges.

- Includes bonus rewards for interacting with their educational content.

- Introduces users to NFTs as part of their earning experience.

- Satoshi Hero

- Combines quizzes, challenges, and leaderboards to engage users.

- Rewards users not only with Bitcoin but also with a sense of achievement through leaderboard competitions.

These faucets demonstrate how gamification can turn earning and learning into a fun and rewarding experience.

Retention Benefits of Gamification

Gamification isn’t just about making crypto faucets more entertaining—it’s about keeping users engaged over the long term.

- Higher Retention Rates

- Faucets with gamified features have been shown to achieve 25–35% higher retention rates compared to traditional “click-and-claim” models (Source: Blockchain.com Research, 2021).

- By offering interactive tasks and rewards, gamified faucets give users a reason to return regularly, building habit-forming engagement.

- Stronger User Engagement

- Gamified faucets create a more active and participatory experience, encouraging users to invest time in learning and completing challenges.

- Users are more likely to explore blockchain concepts deeply when they’re rewarded for their efforts.

- Community Building

- Features like leaderboards, competitions, and NFT rewards foster a sense of community among users.

- This sense of belonging further drives participation and ensures that users stay invested in the platform.

Why Gamification Is Essential for Adoption

Gamified faucets are more than just fun—they’re effective. By combining learning, earning, and engagement, they address the three biggest challenges in crypto adoption:

- Education: Users gain practical knowledge about wallets, transactions, and DeFi.

- Onboarding: Faucets provide a low-risk, entertaining entry point to crypto.

- Retention: Gamification keeps users coming back, ensuring they stay engaged and learn more over time.

For countries developing a national cryptocurrency strategy, gamified faucets can be a valuable tool for reaching and retaining grassroots users. By making crypto fun and rewarding, these platforms drive sustained adoption and empower individuals to participate in the blockchain economy.

In the next section, we’ll explore how crypto faucets bridge the gap between retail and institutional adoption, ensuring that grassroots participants have the knowledge and tools to engage alongside large-scale institutional efforts.

Bridging the Gap Between Retail and Institutional Adoption

When it comes to cryptocurrency adoption, there’s often a disconnect between institutional strategies and retail participation. Governments and large institutions tend to focus on building crypto reserves and integrating blockchain into high-level financial infrastructure. However, these efforts alone can’t drive widespread adoption. To succeed, a balanced strategy is needed—one that empowers individuals at the grassroots level to participate alongside institutions.

This is where crypto faucets play a pivotal role. By providing individuals with the tools and education to engage with cryptocurrency, faucets ensure that retail adoption complements institutional initiatives.

Aligning Retail Efforts with National Strategies

National cryptocurrency strategies often prioritise institutional adoption for economic and financial innovation. Governments invest in digital asset stockpiles, develop blockchain-powered systems, and incentivise institutional use cases, such as cross-border payments and transparent financial governance. But without grassroots participation, these strategies are incomplete.

Here’s how grassroots adoption—driven by tools like crypto faucets—aligns with institutional goals:

- Complements Institutional Crypto Reserves:

- Governments building national crypto reserves (e.g., Bitcoin or CBDCs) rely on widespread understanding and use of crypto for economic stability.

- Grassroots adoption ensures that individuals are equipped to use these reserves effectively, creating a seamless flow between institutional and retail participation.

- Drives Economic Participation:

- When individuals are educated and engaged in the crypto economy, they contribute to its growth by using crypto for payments, savings, and investments.

- A retail-driven approach creates financial inclusion, empowering underserved communities to take part in the digital economy.

- Builds a Balanced Blockchain Ecosystem:

- National strategies work best when both retail users and institutions are active participants in the blockchain economy.

- Faucets ensure that individual adoption scales alongside institutional initiatives, creating a well-rounded and inclusive ecosystem.

Case Study: El Salvador’s Dual Approach

El Salvador’s adoption of Bitcoin as legal tender in 2021 provides a powerful example of how grassroots efforts can complement institutional strategies.

- Institutional Adoption:

- The Salvadoran government created a Bitcoin reserve to support the economy and integrated Bitcoin payments into the country’s financial infrastructure.

- Major initiatives, like legalising Bitcoin for transactions and investments, positioned the country as a leader in national-level crypto adoption.

- Grassroots Participation with Chivo Wallet:

- To drive retail adoption, the government launched Chivo Wallet, a mobile app that allows citizens to send, receive, and store Bitcoin easily.

- Each citizen received $30 worth of Bitcoin as an incentive to download and use the wallet.

- Within a year, 4 million Salvadorans (over 60% of the population) adopted Chivo Wallet, enabling them to participate in the country’s Bitcoin economy.

- Key Takeaway:

- El Salvador’s success demonstrates that grassroots participation fuels national strategies. Without tools like Chivo Wallet to onboard retail users, the institutional adoption of Bitcoin would have had limited impact.

- This approach highlights the importance of empowering individuals through accessible platforms like wallets and faucets.

Why Bridging the Gap Matters

The gap between institutional and retail adoption isn’t just about scale—it’s about inclusion. Here’s why bridging this gap is essential:

- Economic Empowerment: When individuals are part of the crypto economy, they have more control over their financial future, contributing to economic growth.

- Sustainable Adoption: Retail users drive the everyday use of cryptocurrencies, making them practical and sustainable for the long term.

- Global Competitiveness: Countries with strong grassroots and institutional adoption are better positioned to lead in the blockchain economy.

Crypto faucets are critical to this process because they educate and onboard retail users into the crypto ecosystem. By bridging the gap between large-scale institutional efforts and individual participation, faucets help create a more inclusive and balanced blockchain economy.

In the next section, we’ll explore how crypto faucets prepare users for a blockchain-driven economy, focusing on skills development, DeFi engagement, and the broader role of faucets in fostering a crypto-ready population.

Preparing for a Blockchain-Driven Future

As cryptocurrency and blockchain technology become increasingly embedded in global economies, preparing individuals for a blockchain-driven future is crucial. Governments, institutions, and platforms must empower users with the skills and knowledge to navigate this new landscape. Crypto faucets, with their low-barrier approach and educational focus, play a vital role in equipping people to participate in this evolving ecosystem.

Empowering Users with Blockchain Knowledge

Crypto faucets don’t just introduce users to digital assets; they also provide hands-on learning opportunities that prepare them for the next phase of blockchain evolution. By combining rewards with education, faucets empower users to engage with more advanced blockchain tools and concepts, such as DeFi, Web3, and dApps.

- Onboarding Users to DeFi Tools

- Decentralised Finance (DeFi) is one of the fastest-growing sectors in blockchain, offering users alternatives to traditional banking. Crypto faucets act as an introduction to these tools by:

- Teaching Staking: Many faucets guide users on how to stake their rewards to earn passive income, showing them the potential of blockchain-powered financial systems.

- Exploring Lending and Borrowing: Faucets often educate users about DeFi platforms like Aave or Compound, where they can lend or borrow crypto assets without intermediaries.

- Yield Farming Basics: Through tutorials or gamified quizzes, faucets introduce users to yield farming strategies, which allow them to maximise their returns by participating in liquidity pools.

- Decentralised Finance (DeFi) is one of the fastest-growing sectors in blockchain, offering users alternatives to traditional banking. Crypto faucets act as an introduction to these tools by:

- Exploring Web3 and dApps

- Web3 represents the next iteration of the internet, emphasising decentralisation, user ownership, and privacy. Crypto faucets prepare users to engage with Web3 through:

- NFT Introductions: Many faucets reward users with NFTs, helping them understand the concept of ownership in the digital space.

- Hands-On dApp Interaction: Faucets sometimes require users to engage with decentralised applications (dApps), giving them practical experience with tools like decentralised exchanges (DEXs) or blockchain-based games.

- Wallet Management: By teaching users how to connect their wallets to Web3 tools, faucets prepare them to navigate a world where personal data and financial assets are managed directly by the user.

- Web3 represents the next iteration of the internet, emphasising decentralisation, user ownership, and privacy. Crypto faucets prepare users to engage with Web3 through:

Through these onboarding processes, faucets provide foundational blockchain knowledge, ensuring that users are ready to fully participate in the crypto economy.

Crypto Faucets’ Role in Future Blockchain Ecosystems

As the blockchain economy grows, crypto faucets will play an essential role in building a crypto-ready population that can integrate digital assets into their daily lives. Here’s how they’ll shape the future:

Teaching Users to Integrate Crypto into Everyday Transactions

For crypto adoption to succeed on a large scale, people need to feel comfortable using digital currencies in everyday scenarios. Faucets teach this by:

- Simulating Real Transactions: By requiring users to set up wallets and claim rewards, faucets mimic the processes users will need to perform in the real world.

- Encouraging Micro-Transactions: Faucets demonstrate how Bitcoin or other cryptos can be used for small purchases, tipping, or savings, making the technology practical and approachable.

- Introducing Payment Systems: Some faucets integrate with crypto payment gateways, helping users understand how to send and receive payments using digital assets.

Bridging Digital Divides with Accessible Technology

One of blockchain’s most significant promises is its potential to bridge the digital divide, providing financial access to underserved populations. Faucets play a key role in this mission by:

- Offering Entry-Level Access: For those without bank accounts or financial literacy, faucets provide a simple way to start participating in the blockchain economy with no upfront investment.

- Connecting Remote Communities: With just a smartphone and internet connection, anyone can use a faucet to start earning and learning about crypto, regardless of their location.

- Building Confidence: Faucets empower users with practical knowledge, giving them the confidence to explore more complex blockchain tools like staking, lending, and decentralised governance.

The Role of Crypto Faucets in Shaping a Blockchain Future

As governments and institutions implement national cryptocurrency strategies, they must ensure that individuals are not left behind. Crypto faucets serve as a stepping stone for users to gain knowledge, experience, and trust in blockchain systems. They lay the foundation for a future where:

- Everyday transactions are powered by cryptocurrency.

- DeFi tools are accessible to everyone.

- Web3 ecosystems are inclusive, bridging the gap between early adopters and mainstream users.

By preparing individuals to engage with blockchain technologies, crypto faucets contribute to the creation of a financially inclusive, blockchain-driven global economy.

Crypto faucets are far more than just a way to earn free cryptocurrency—they’re tools for education, inclusion, and empowerment. By teaching blockchain basics, onboarding users to advanced tools like DeFi and Web3, and fostering grassroots adoption, faucets align perfectly with the goals of national cryptocurrency strategies. They ensure that individuals, especially those in underserved communities, have the skills and resources to thrive in a blockchain-powered future.

Through their accessible, low-risk, and gamified approach, crypto faucets are paving the way for a more inclusive and decentralised economy, bridging the gap between institutional initiatives and everyday users.

Conclusion

To build a truly inclusive and effective blockchain ecosystem, grassroots adoption must be at the core of national cryptocurrency strategies. While governments and institutions focus on building digital reserves and integrating blockchain into large-scale financial systems, empowering individuals is equally critical. Grassroots tools like crypto faucets ensure that people from all walks of life can participate in this evolving digital economy.

Why Grassroots Adoption Matters

Crypto faucets address two key challenges in national crypto strategies:

- Financial Inclusion: By removing entry barriers, faucets provide underbanked and unbanked populations with free and simple access to cryptocurrency. This creates opportunities for economic participation in regions where traditional financial systems have failed.

- Education and Engagement: Faucets serve as educational platforms, teaching users the basics of blockchain, wallets, and decentralised finance (DeFi). This hands-on learning prepares individuals to engage confidently with the blockchain-driven economy of the future.

By bridging the gap between retail and institutional adoption, crypto faucets foster a balanced, inclusive ecosystem where individuals can contribute alongside governments and institutions.

Crypto Faucets: Tools for Empowerment

Throughout this article, we’ve explored how faucets are uniquely positioned to:

- Democratise access to cryptocurrency, enabling millions to earn micro Bitcoin reserves without financial risk.

- Equip users with blockchain knowledge, empowering them to navigate the complexities of decentralised finance and Web3.

- Drive engagement through gamification, ensuring sustained interest and participation in the blockchain economy.

These platforms do more than just distribute small amounts of cryptocurrency—they unlock opportunities for users to grow their financial literacy, engage with blockchain tools, and become active participants in a global digital ecosystem.

If governments and institutions want to maximise the potential of their national cryptocurrency strategies, they must recognise the pivotal role of grassroots tools like crypto faucets. Here’s why:

- Without retail participation, institutional adoption alone cannot create a fully functional blockchain economy.

- Crypto faucets are a low-cost, scalable solution for educating and onboarding millions of users worldwide.

- Prioritising grassroots adoption ensures a more equitable and inclusive transition to blockchain-driven systems.

Governments, institutions, and blockchain innovators must invest in, promote, and integrate faucets as part of their broader blockchain strategy. By doing so, they can lay the foundation for a more decentralised, inclusive, and sustainable financial future—one where everyone has the tools to thrive.